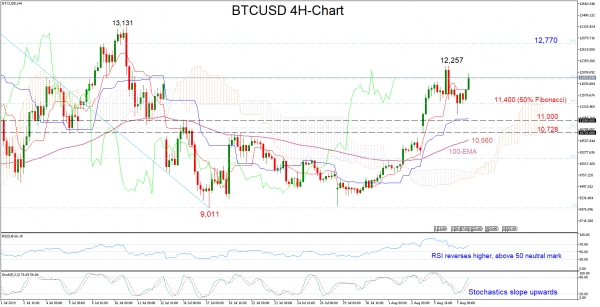

Demand for Bitcoin accelerated this week, with the price running as high as 12,257 on Wednesday before pulling back to the 11,400 support area.

The market could retest its latest peaks as the recent rebound in the RSI and the positive slope in the Stochastics in the four-hour chart back a bullish scenario for the short-term. Crawling higher, the bulls would aim for a close above the July high of 13,131 but they should first breach the wall around 12,770 to help the rally to keep going. The latter is also coinciding with the 78.6% Fibonacci extension of the long donwleg from 13,809 to 9,011.

A resumption of the negative mood may squeeze the market towards the 50% fibo of 11,400, while lower, the 11,000 round-mark could deter the price from touching the 10,728 restrictive number. If the latter proves easy to get through, the spotlight will shift to the 100-period exponential moving average (EMA) of 10,560 that proved reliable in halting market actions in previous sessions.

Summarizing, although the bullish pressure in the Bitcoin market has recessed over the past few days, the short-term risk continues to hold on the upside.