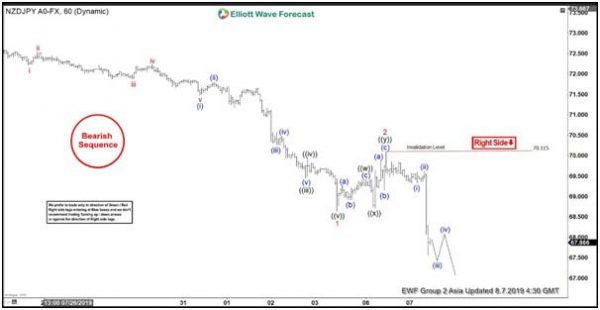

NZDJPY plunges as Reserve Bank of New Zealand (RBNZ) cut the interest rate by 50 basis point. The pair already has a bearish sequence prior to the rate decision, and the rate cut speeds up the extension lower. Short term Elliott Wave view suggests that the rally to 73.2 high on July 22, 2019 ended wave B.

Pair is in wave C lower with subdivision as a 5 waves impulse Elliott Wave structure. Down from 73.2, wave 1 ended at 68.64 and the internal also subdivides as a 5 waves impulse in lesser degree. Wave ((i)) of 1 ended at 72.29 and wave ((ii)) of 1 pullback ended at 72.595. Pair then rallied in wave ((iii)) of 1 towards 69.45, wave ((iv)) of 1 ended at 69.95, and wave ((v)) of 1 ended at 68.64.

Wave 2 rally ended at 70.11 with the internal unfolded as a double zigzag. Pair has since resumed lower and breaks below wave 1 at 68.64, suggesting the next leg lower has likely started. Near term, while bounce stays below 70.1, expect pair to extend lower. We don’t like buying the pair and expect any rally to fail in 3, 7, or 11 swing as far as pivot at 70.1 stays intact.

NZDJPY 1 Hour Elliott Wave Chart