EUR/USD started a solid recovery from the 1.1040 area and climbed above 1.1150. Conversely, USD/CHF declined heavily and settled below the key 0.9800 support area.

Important Takeaways for EUR/USD and USD/CHF

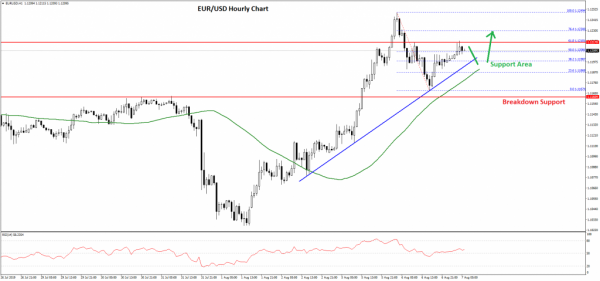

- The Euro recovered nicely above the 1.1100 and 1.1150 resistance levels against the US Dollar.

- There is a major bullish trend line forming with support near 1.1195 on the hourly chart of EUR/USD.

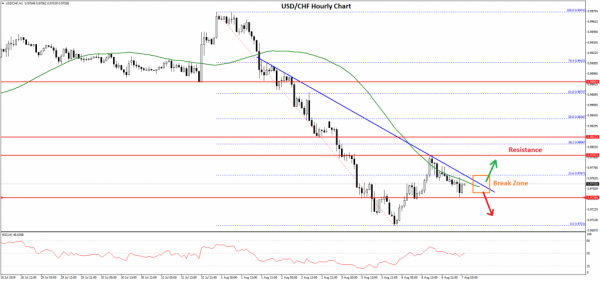

- USD/CHF declined heavily below the 0.9800 and 0.9780 support levels.

- There is a key bearish trend line forming with resistance near 0.9765 on the hourly chart.

EUR/USD Technical Analysis

This past week, the Euro declined heavily below the 1.1120 and 1.1100 support levels against the US Dollar. The EUR/USD pair tested the 1.1040 support area and recently started a solid recovery.

It broke the 1.1100 and 1.1120 resistance levels. Moreover, there was a break above the 1.1150 resistance and the 50 hourly simple moving average. Finally, the pair traded above the 1.1200 resistance and formed a swing high near 1.1249 on FXOpen.

It corrected gains from 1.1249 and tested the 1.1170-1.1180 support area. Moreover, there is a major bullish trend line forming with support near 1.1195 on the hourly chart of EUR/USD.

The pair is currently trading above the 50% Fib retracement level of the recent decline from the 1.1249 high to 1.1167 low, and the 50 hourly simple moving average.

An immediate resistance on the upside is near the 1.1220 level. Moreover, the 61.8% Fib retracement level of the recent decline from the 1.1249 high to 1.1167 low is also near the 1.1218 level.

Therefore, a successful break above the 1.1220 resistance might open the doors for more upsides in the near term. The next key resistances are near the 1.1250 and 1.1265 levels.

On the downside, an initial support is near the 1.1195 level. If there is a downside break below the trend line, the 50 hourly simple moving average, and 1.1180, the pair could retreat towards the 1.1120 support level in the coming sessions.

USD/CHF Technical Analysis

The US Dollar failed to surpass the 1.0000 resistance and started a strong decline against the Swiss franc. The USD/CHF pair broke the 0.9900 and 0.9840 support levels to move into a bearish zone.

Moreover, there was a close below the 0.9800 support and the 50 hourly simple moving average. Finally, the pair traded below the 0.9740 support and tested the 0.9700 support area.

A swing low was formed near 0.9703 and the pair recently started an upside correction. It broke the 0.9740 resistance plus the 23.6% Fib retracement level of the downward move from the 0.9974 high to 0.9703 low.

However, the pair struggled to surpass the 0.9800 resistance and the 50 hourly SMA. Moreover, there is a key bearish trend line forming with resistance near 0.9765 on the hourly chart.

Therefore, if there is a successful break above the 0.9765 resistance, there could be more upsides. However, the main resistance is near the 0.9800 level, above which the pair could start a decent upward move.

Conversely, if there is no upside break above 0.9765 and 0.9800, the pair could resume its decline. An immediate support is near the 0.9740 level, below which USD/CHF might revisit the 0.9700 support level in the near term.