The US Nonfarm Payrolls on Friday could even be called boring: the report showed the preservation of a completely healthy labour market, in some ways even exceeding expectations. However, at the end of the day, as we expected, the markets began to experience a proliferation of trade disputes. Reduced summer liquidity also obviously has an impact on market dynamics, amplifying amplitude.

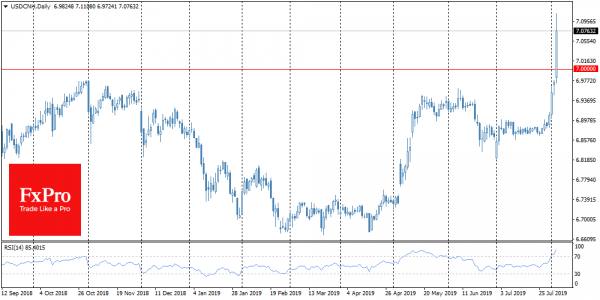

On Monday morning, a rather gloomy picture developed on the stock markets. The Chinese yuan fell by 2% – the largest intraday drop since August 2015. More importantly, the pair crossed 7.0, triggering speculation that China switched to using the national currency as a weapon in trade wars.

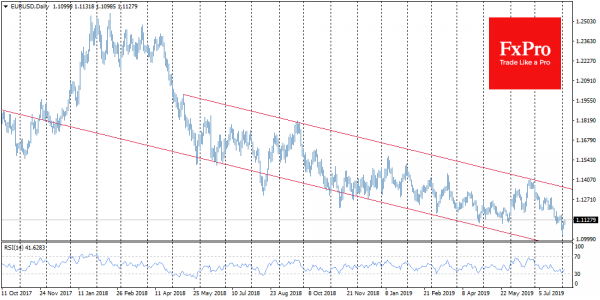

Fears that the two largest economies are seeking to weaken their currency rates in order to gain a competitive advantage caused the markets to be seriously worried. However, there is a lack of political will to assure markets that the national currencies are not a new weapon in trade wars. And that is the most dangerous thing in such a situation.

Consequently, there are fears that the “beggar-thy-neighbour” policy is returning to the markets – an approach that was actively used in the 1930s and ended with the Great Depression. Moreover, it seems that politics is now overshadowed by the economy, and this is a bad sign for the markets.

Asian indices marked the worst day this year, and the protective yen, franc and gold each experienced a sharp influx of buyers. Since the beginning of the month, the yen strengthened by 2.5% against the backdrop of an increased wave into defensive assets. Over six trading sessions, the SPX fell by 4%, which is the worst performance since December 2018.

Meanwhile, the announcement of tariffs caused a weakening of the dollar, as traders began to increase their expectations of lowering the Fed interest rates in September. Markets also talked about the fact that Trump announced the fees in order to force the Fed to go for another rate cut.