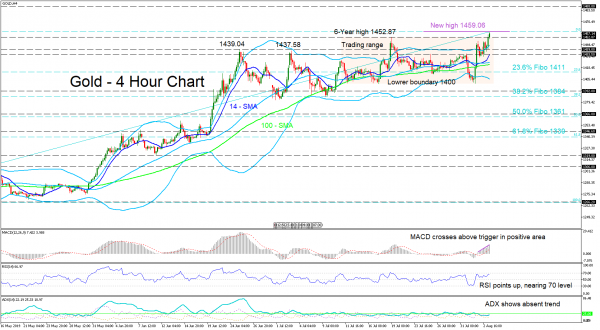

Gold tested the 1400 hurdle for the third time over the last three weeks, and then rallied past the previous highs of 1437.58 and 1439.04 from July 3 and June 25. The metal then took a breather, and today moved above its six-year high of 1452.87, to produce a current new high of 1459.06.

Although the 20- and 100-day simple moving averages (SMAs) are nearly parallel and flat, suggesting some neutrality, the 14-day SMA has broken above the 20-day SMA and has a steep incline showing some upwards strength. It is worth mentioning that at this point the Bollinger outer bands have moved apart, implying that volatility could pick up.

The MACD has crossed its zero and red trigger line into the positive region, and is indicating upside acceleration, whereas the RSI has turned up again and is nearing the 70 level but has yet to enter the overbought region. The ADX agrees with the 20- and 100-day SMAs neutral view.

If the 1452.87 support barrier holds, which also happens to be the upper boundary of the short-term trading range and bullish behavior persists, the price jump could start a new ascent to test the 1488 resistance coming from back in April 2013. Only a breach of the 1488 level could bring attention to a higher resistance of 1522, from December 2011.

In a downwards scenario where sellers push the price below the 1452.87 support, first friction would come from the upper band currently around 1445, before a support region of 1439.04 – 1433.50, where the 14-day SMA also lies.

Summarizing, short-term bullish bias seems to be revived and could evolve into a trend, but a downwards fall past the 1400 hurdle could turn the outlook to neutral.