Political risk to drag US dollar lower

The US dollar will end the week down against most major pairs even after the U.S. Federal Reserve hiked rates by 25 basis points and the plan to keep tightening via more rate hikes and a reduction of the central bank’s balance sheet was part of the communication on Wednesday. Economic data released this week has the market questioning how serious the Fed is about its economic forecasts as inflation, retail sales and building permits all came in lower than expected this week. The Trump administration continues to be caught in the turmoil of the Russian connection investigation and it now appears the President will be under investigation doing the dollar no favors.

Central banks dominated headlines this week even if they did not feature a policy statement. The Bank of Canada (BoC) surprised markets when during a routing speech the Deputy Governor Carolyn Wilkins said that the central bank would be assessing its monetary policy if the current pace of growth continues. A second endorsement for reducing stimulus came a day later from Governor Stephen Poloz when he said the rate cuts from two years ago had done their job. The Fed was the only central bank to modify its monetary policy but the Bank of England (BoE) delivered a hawkish vote count in their 5–3 decision to keep rates unchanged. The three votes for a rate hike came despite the uncertain waters the economy must transverse during the upcoming Brexit negotiations.

The Bank of Japan (BOJ) kept interest rates no hold and after the European Central Bank (ECB) and BoE have changed their tune about ultra easing monetary policy Japan could be the last major economy without a tighter monetary policy. The week will bring few scheduled economic events, the highlight being the Reserve Bank of New Zealand (RBNZ) rate statement on Wednesday, June 21 at 4:00 pm EDT. The optimism resulting form the BoC comments will be put to the test on Thursday, June 22 with the release of Canadian retail sales and again on Friday, June 23 at 8:30 am EDT when Canadian inflation data is published.

The EUR/USD gained 0.047 percent this week. The single pair is trading at 1.1188 after softer economic data out of the US offset the actions of the Fed. The monetary policy divergence that had the USD on the path to appreciate further has been hindered by political drama despite the Fed sticking to the script by hiking two times this year with the possibility of another rate raise before the end of the year and outlining their plans to reduce their massive balance sheet.

The EUR/USD will end nearly flat and all the Fed could do was bring the pair to just below the 1.12 price level. The high of the week was 1.1296 just before the Fed release its June statement.

The economic calendar for the week of June 19 to 23 will provide little guidance for investors with news of US President Donald Trump under possible investigation for obstruction of justice to provide further volatility. The probability of impeachment is low and if anything all investigations could drag on for years. The market is now starting to price in the reality of the end of the Trump trade with no solid timelines on what kickstarted the strength of the dollar after the US presidential elections. Infrastructure spending and tax reform are now tougher sells as the President does not have the full support of his party, even if they hold the majority.

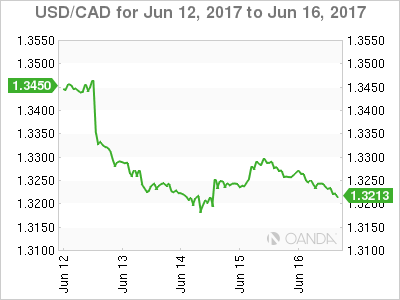

The USD/CAD lost 1.411 percent in the last five days. The currency pair is trading at 1.3241 after comments from the Bank of Canada (BoC) Deputy governor put a rate hike firmly on the table. Governor Stephen Poloz followed up on the comments the next day and confirmed the optimism on the growth of the economy and the possible reduction of stimulus going forward. The loonie rallied until the U.S. Federal Reserve delivered its own optimistic view on the American economy while hiking rates for the second time this year. The hike was not enough to offset the negative indicators delivered this week that contradict the picture painted by the Fed’s forecasts.

The CAD advanced despite little support from oil prices who suffered from another surprise buildup, this time in gasoline stocks. The battle to stabilize crude prices between the Organization of the Petroleum Exporting Countries (OPEC) and US producers continues to show the glut of energy products remain.

The biggest risk for the Canadian dollar remains a political one. The renegotiation of the NAFTA is scheduled for late August and a negative outcome could reshape the Canadian economy for the worse. The turmoil in the Trump Administration has taken some of the pressure off, but the consultation process needed before renegotiation was initiated as anticipated and the soft lumber tariffs to Canadian producers sent a strong message ahead of sitting down at the negotiation table.

Market events to watch this week:

Monday, June 19

- 9:30pm AUD Monetary Policy Meeting Minutes

Tuesday, June 20

- 2:30 am CHF SNB Chairman Jordan Speaks

- 4:45 am CHF SNB Chairman Jordan Speaks

Wednesday, June 21

- 10:30 am USD Crude Oil Inventories

- 4:00 pm NZD RBNZ Rate Statement

- 5:00 pm NZD Official Cash Rate

Thursday, June 22

- 8:30 am CAD Core Retail Sales m/m

- 8:30 am USD Unemployment Claims

Friday, June 23

- 8:30 am CAD CPI m/m

*All times EDT