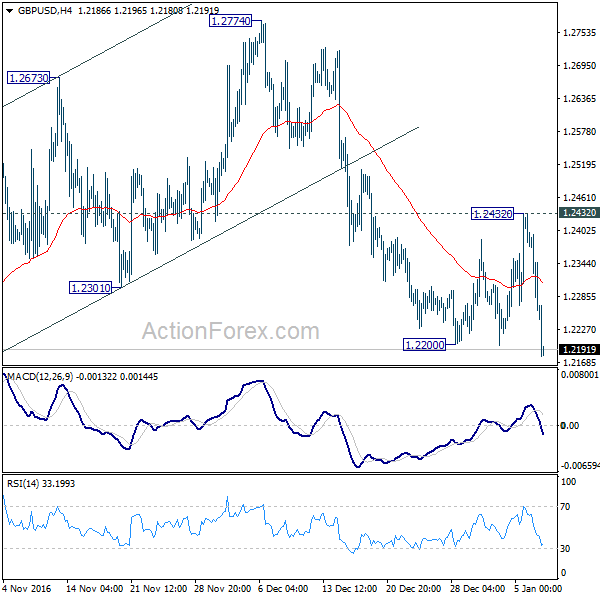

Daily Pivots: (S1) 1.2217; (P) 1.2324; (R1) 1.2387; More…

GBP/USD’s fall from 1.2774 resumed by taking out 1.2200 and reaches as low as 1.2179 so far. Intraday bias is back on the downside for 1.1946 low. As noted before, corrective rise from 1.1946 has completed at 1.2774 and larger down trend is possibly resuming. This is supported by the rejection from 55 day EMA. Decisive break of 1.1946 will confirm this bearish case. Meanwhile, break of 1.2432 resistance will indicate that fall from 1.2774 is completed and correction from 1.1946 is extending with another rise.

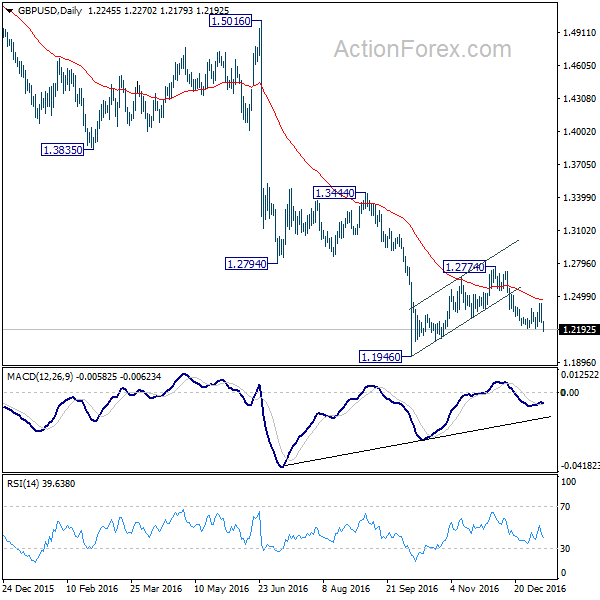

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term bottoming yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box