For the 24 hours to 23:00 GMT, the GBP declined 1.23% against the USD and closed at 1.2224, after Boris Johnson’s government reiterated that Britain is prepared to leave the European Union without a deal on 31 October, unless the European Union renegotiated.

On the data front, UK’s net consumer credit advanced £1.0 billion in June, following a revised rise of £0.9 billion in the prior month. Moreover, the nation’s mortgage approvals for house purchases climbed to a level of 66.4K in June, higher than market consensus for a rise to a level of 65.8K. In the previous month, mortgage approvals for house purchases had registered a revised level of 65.6K.

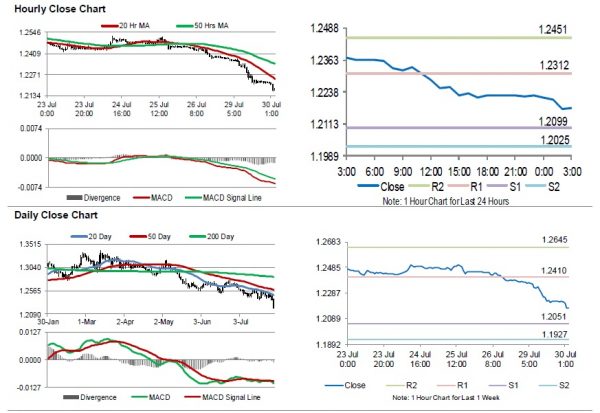

In the Asian session, at GMT0300, the pair is trading at 1.2174, with the GBP trading 0.41% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2099, and a fall through could take it to the next support level of 1.2025. The pair is expected to find its first resistance at 1.2312, and a rise through could take it to the next resistance level of 1.2451.

Trading trend in the Sterling today, is expected to be determined by UK’s GfK consumer confidence index and Lloyds business barometer, both for July, se to release overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.