Key Highlights

- The Euro failed to hold the 1.1200 support and declined heavily against the US Dollar.

- A major bearish trend line is forming with resistance near 1.1215 on the 4-hours chart of EUR/USD.

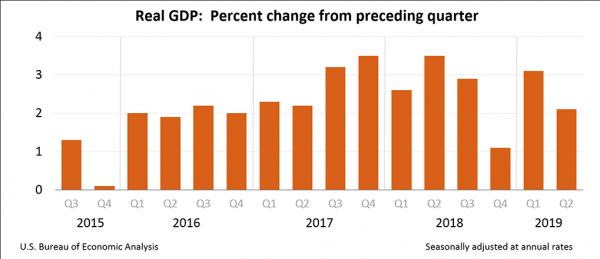

- The US Gross Domestic Product grew 2.1% in Q2 2019 (Prelim), more than the 1.8% forecast.

- The Spanish CPI in July 2019 (Prelim) could increase 0.4% (YoY), similar to the last change.

EURUSD Technical Analysis

The Euro made another attempt to climb above the 1.1280 resistance against the US Dollar. However, the EUR/USD pair struggled to continue higher and declined heavily below 1.1250 and 1.1200.

Looking at the 4-hours chart, the pair clearly made many attempts to surpass the 1.1280 and 1.1285 resistance levels. However, the bulls failed to gain strength above 1.1280, resulting in heavy downsides.

The pair broke the main 1.1200 support area to move into a bearish zone. It even declined below the 1.1150 support plus settled well below the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

The pair traded close to the 1.1100 level and a new monthly low was formed at 1.1101. Later, there was a sharp upside correction above the 1.1140 and 1.1150 levels.

However, the recovery was capped by the 1.1180 resistance plus the 50% Fib retracement level of the downward move from the 1.1280 high to 1.1101 low. The pair trimmed most gains and traded below the 1.1150 level.

On the downside, the main support is near the 1.1100 level, below which the pair could start a significant downward move towards the parity level. On the upside, the main resistances are near 1.1180 and 1.1200 levels. There is also a major bearish trend line forming with resistance near 1.1215 on the same chart.

Fundamentally, the US Gross Domestic Product report for Q2, 2019 (Prelim) was released by the US Bureau of Economic Analysis. The market was expecting the US GDP to grow by 1.8%, less than the last 3.1%.

However, the actual result was better than the forecast, as the US GDP grew by 2.1% (according to the “advance” estimate).

The report added:

Current-dollar GDP increased 4.6 percent, or $239.1 billion, in the second quarter to a level of $21.34 trillion. In the first quarter, current-dollar GDP increased 3.9 percent, or $201.0 billion.

Overall, the US Dollar remains in a strong uptrend and it seems like there could be more downsides in EUR/USD, GBP/USD and AUD/USD in the near term.

Economic Releases to Watch Today

Spanish CPI July 2019 (YoY) (Prelim) – Forecast 0.4%, versus 0.4% previous.

UK’s Consumer Credit June 2019 – Forecast £0.967B, versus £0.822B previous.