Key Highlights

- Crude oil price topped near $60.80 and declined sharply below $57.00 against the US dollar.

- A bearish trend is forming with resistance near $57.80 on the 4-hours chart of XTI/USD.

- The US Manufacturing PMI in July 2019 (Prelim) declined from 50.6 to 50.0.

- The US Durable Goods Orders in June 2019 could increase 0.7%, better than the last -1.3%.

Crude Oil Price Technical Analysis

After struggling to clear the $60.80 resistance, crude oil price started a fresh decrease against the US Dollar. The price broke the $60.00 and $58.00 support levels to enter a short term bearish zone.

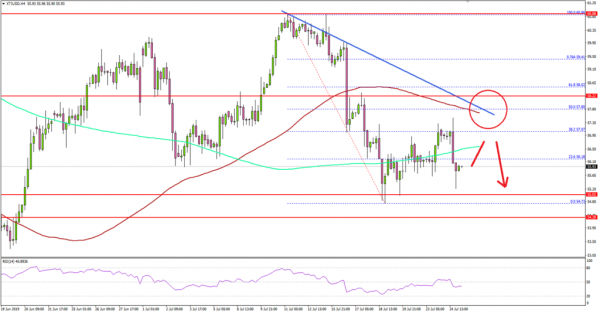

Looking at the 4-hours chart of XTI/USD, the price declined sharply below the $58.00 and $56.00 support levels. There was also a close below $58.00 and 100 (red) simple moving average (4-hours).

Finally, the price spiked below the $55.00 support and traded as low as $54.73. Recently, the price started an upside correction above $56.00 plus the 23.6% Fib retracement level of the decline from $60.86 to $54.73.

However, there is a crucial resistance forming on the upside near the $57.80 and $58.00 levels. Moreover, there is a bearish trend forming with resistance near $57.80 on the same chart. The trend line also coincides with the 50% Fib retracement level of the decline from $60.86 to $54.73.

Therefore, the price is likely to struggle near the $57.80 and $58.00 resistance levels. If there is an upside break and close above $58.00, the price could climb back towards $60.00.

Conversely, the price might decline again below $56.00 if it fails to climb above the $58.00 resistance in the coming sessions.

Fundamentally, the US Manufacturing Purchasing Managers Index (PMI) for July 2019 (Prelim) was released by the Markit Economics. The market was looking for an increase from 50.6 to 51.0.

The actual result very disappointing as the PMI declined to 50.0 (118-month low) and failed to post a decent expansion. Moreover, the Flash U.S. Manufacturing Output Index came in at 48.9, down from 51.2 (119-month low).

The report by the Statistics Canada added:

Service sector companies recorded the strongest rise in business activity since April. This helped to offset a downturn in manufacturing production in July. Although only marginal, the reduction in output across the goods producing sector was the sharpest for almost ten years.

Looking at major pairs, EUR/USD and GBP/USD recovered slightly, but remained in a bearish zone.

Economic Releases to Watch Today

- German IFO Business Climate Index for July 2019 – Forecast 97.1, versus 97.4 previous.

- ECB Interest Rate Decision – Forecast 0%, versus 0% previous.

- US Initial Jobless Claims – Forecast 218K, versus 216K previous.

- US Durable Goods Orders for June 2019 – Forecast +0.7% versus -1.3% previous.