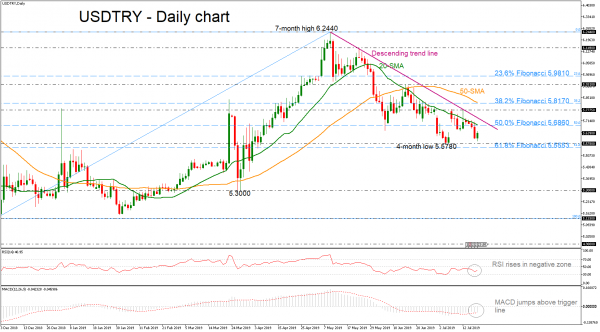

USDTRY has been in a downtrend over the last two months following the pullback on the seven-month high of 6.2440. The pair is holding beneath the 20- and 50-simple moving averages (SMAs), however, the momentum indicators are signaling for some gains in the short-term. The RSI is pointing marginally up in the negative zone, while the MACD posted a bullish crossover with its trigger line below the zero line.

In case of another step lower and a penetration of the four-month low of 5.5780, the price could touch the immediate support of the 61.8% Fibonacci mark of the upward wave from 5.1330 to 6.2440 around 5.5553. Steeper declines could push the price until the 5.3000, registered on March 26.

Alternatively, if the market corrects higher, the very short-term bullish action may pause initially near the 50.0% Fibo of 5.6860, which stands near the falling trend line. A rally on top of the latter would probably stage fresh buying pressure with the price moving next to the 5.7775 level and the 38.2% Fibonacci region of 5.8170, which coincides with the 50-day SMA.

Finally, the price is still developing in a descending move in the near term, and traders should wait for a penetration of the diagonal line for posting gains.