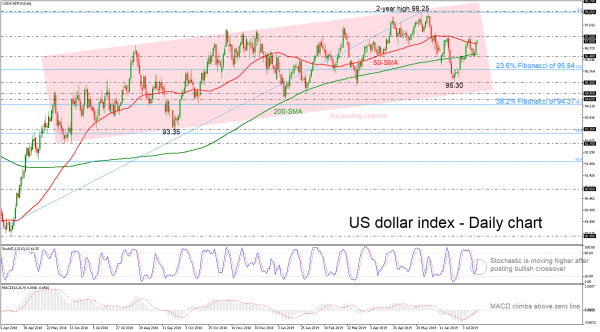

The US dollar index had a successful daily close above the 50-simple moving average (SMA) suggesting remarkable gains, during yesterday’s trading session. The stochastic oscillator is moving higher after it completed a bullish crossover within the %K and %D lines, while the MACD is trying to strengthen its bullish momentum above zero line.

Should the price stretch north and clear the 97.20 resistance, the two-year high of 98.25 could come in focus near 98.25. If the buying interest extends, attention could then turn to the 98.70 resistance barrier, taken from the minor low on March 2017.

On the flipside, in case of a failed attempt to clear the 50-SMA, prices would test the 96.40 support level, which stands near the 200-SMA. If traders continue to sell the index, the price could decline until the 23.6% Fibonacci retracement level of the upward movement from 88.10 to 98.25 near 95.84.

Summarizing, in the long-term, the market retains the bullish structure as it has been trading within an ascending sloping channel since June 2016 but in the short-term, traders need to wait for a jump above the 97.20 hurdle for positive orders again.