Putting out fires with gasoline will never be a good life decision, but that is what happened overnight with crude oil exploding, to the downside.

For OPEC, an oversupply headache became a migraine overnight as oil slumped by 4 % after the release of the U.S. DOE Crude Inventory numbers. In fact, it wasn’t the crude inventory number itself that started the rot, although the drawdown of -1.66 million barrels was less than expected, rather it was the gasoline inventories which came in at +2.1 million bpd against an expected reduction of -1.15 million bpd.

Given we are in U.S. driving season, this was unexpected and suggests that the persistent surplus is being shunted further down the oil value chain. Instead of being stored in huge tanks in Cushing Oklahoma as crude, it is being taken out, refined into gasoline and err, being stored in huge tanks. The gasoline inventories don’t normally have such an aggressive effect on crude prices. What is perhaps enlightening, therefore, is the light it shines on market sentiment. It would appear that the support was nervously wobbling before the numbers with the release being the straw that broke the camels back.

The gasoline inventories don’t normally have such an aggressive effect on crude prices. What is perhaps enlightening, therefore, is the light it shines on market sentiment. It would appear that the support was nervously wobbling before the numbers with the release being the straw that broke the camels back.

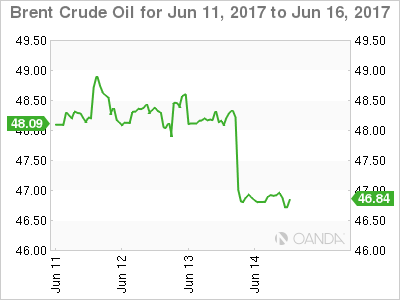

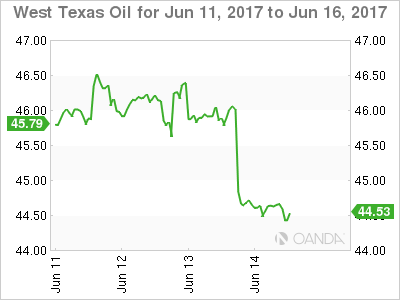

Brent and WTI didn’t hang around though, with both contracts heading out of the door and turning South at high speed. Brent and WTI both finished the New York session at their lows, a bearish technical development in itself, and are now eyeing the panic liquidation lows of early May.

Brent spot opened at 46.85 this morning with well-formed resistance now at 48.50. The May low at 46.05 is the first support followed by 45.50.

WTI spot opened at 44.60 with substantial resistance above 46.25. The May low at 43.55 is initial support with a daily close below here possibly targeting the November lows around 42.00.

A break of the latter level on WTI would no doubt send shockwaves through both OPEC/Non-OPEC and U.S. Shale. It would shine the spotlight on Saudi Arabia, much to their reluctance, as the world’s only major swing producer capable of making rapid, meaningful cuts to rebalance prices urgently. Its effect on the OPEC/non-OPEC alliance could turn either way. On the one hand, they may be faced with the unpalatable scenario of deepening the production cut agreement and then adhering to it. On the contrary, it may spawn a noncompliance every man for himself situation and undermine the agreement terminally.