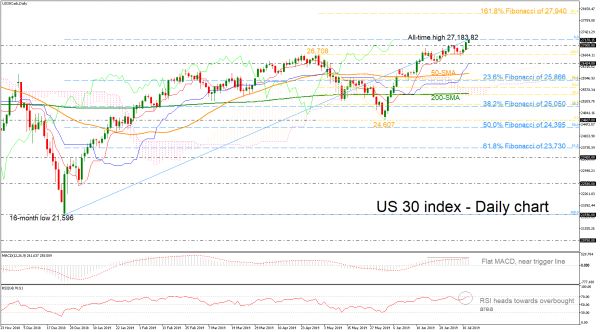

The US 30 index has been in a flying mode over the last couple of days, resting near a fresh all-time high of 27,183.82.

The flat momentum in the MACD, which trends above its trigger line, signals that fresh record highs can be achieved but the volatility in the price would weaken. Still, the RSI warns that the market is approaching overbought territory and hence downside corrections cannot be ruled out.

Jumping above the latest record high, the index could hit the 161.8% Fibonacci extension level of the downfall from the 26,708 high to the 24,607 low near 27,940.

Otherwise, if the market weakens below the 27,000 psychological mark, the 26,424 support, which overlaps with the blue Kijun-sen line could come into focus. Moving lower, the 50-day simple moving average (SMA) currently at 26,108 could attract traders’ attention before touching the 23.6% Fibonacci region of the upleg from 21,596 to 27,183.82 near 25,866.

In the long-term picture, a bull market began after the jump above the previous high of 27,000. In case of a drop below the 23.6% Fibo of 25,866 the outlook could switch to neutral.