Dollar recovered overnight as Fed delivered the widely expected rate hike. The overall announcement, including new economic projections, was not as bad as some anticipated. Fed maintained the projection of a total of three rate hike this year. Downward revision in 2017 inflation forecast was somewhat offset by the upward revision in GDP forecast and downward revision in unemployment rate forecast. On other hand, both growth and inflation forecasts for 2018 and 2019 were held unchanged. While the greenback was lifted, it’s clearly not out of the woods yet as markets seem not fully convinced by what Fed said.

More on FOMC Rate Decision:

- Dollar Recovers after Not that Dovish Fed Hike

- Fed Stands By Its Rate Path

- FOMC: Model Dominates the Outlook Over Current Inflation

- Fed Raises Rates Hoping Inflation Turns Soon

- No Surprise as the Fed Raises Rates, Continues to Signal Gradual Tightening

- Dollar Surges As Hawkish Fed Raises Rates, Maintains Rate Outlook, Talks Balance Sheet Reduction

TNX stays in near term down trend

Reactions in treasury yield is an evidence the markets are not as optimistic as Fed. 10 year yield dipped to as low as 2.103 after yesterday’s CPI disappointment. FOMC decision lifted TNX mildly to close at 2.138. But that’s still way off prior day’s close at 2.207. Near term outlook will remain bearish as long as 2.229 resistance holds. And we’d expect further decline to 50% retracement of 1.336 to 2.621 at 1.9785.

Fed fund futures implies just 18% chance of September hike

Fed fund futures are pricing in just 18.03% chance of another rate hike in September. That’s lower than prior day’s pricing at 28.19% and last month’s pricing at 26.7%.

Dollar stays bearish against Euro, Swiss Franc, Yen and Loonie

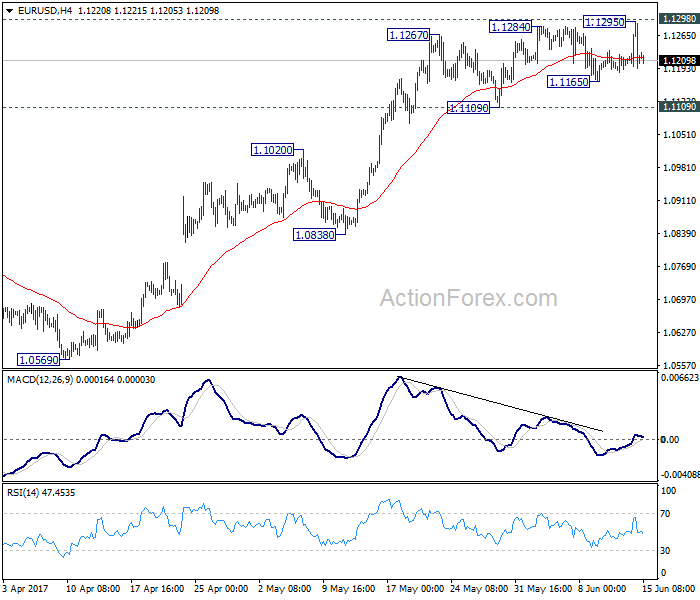

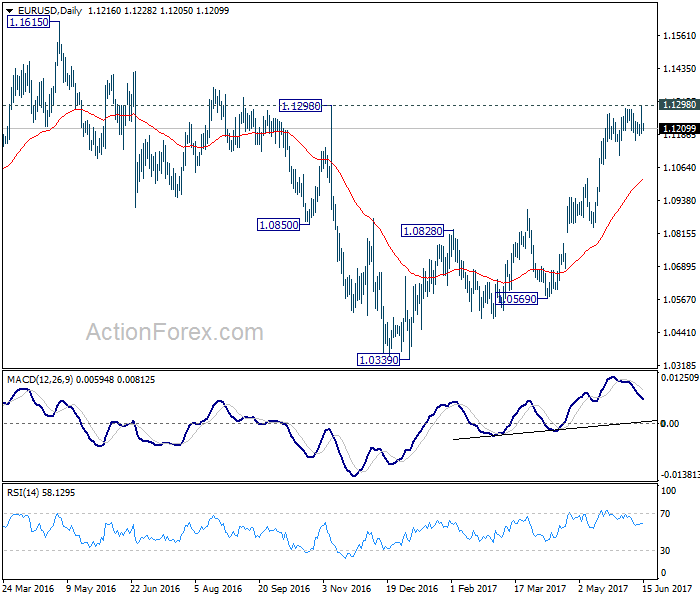

Technically, while EUR/USD failed to take out 1.1298 key resistance, it’s still holding well above 1.1109 near term support. For now, outlook in EUR/USD stays bullish and current development could be just delaying the upside breakout. Meanwhile, USD/CHF is held well below 0.9807 resistance. USD/JPY is staying bearish with 110.80 resistance intact. USD/CAD also stays well below 1.3387 support turned resistance and remains bearish.

Aussie lifted by job data

Australia unemployment rate unexpectedly dropped to 5.5% in May, down from 5.7% and below expectation of 5.7%. That’s also the lowest number since February 2013. Headline job number showed 42k growth, well above expectation of 10k. Full-time jobs grew 52.1k while part-time jobs fell -10.1k. Participation rate also rose 0.1% to 64.9%. Speculations of a rate cut by RBA receded after the release.

Kiwi underwhelmed by GDP miss

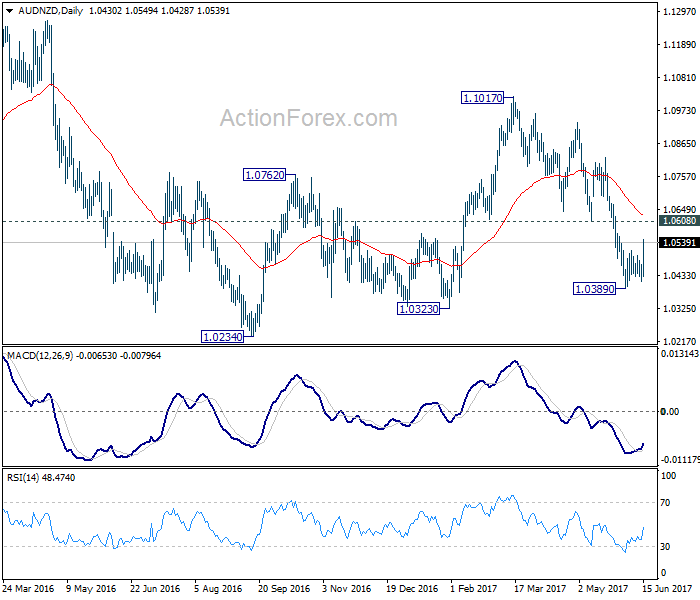

On the other hand, New Zealand GDP grew only 0.5% qoq in Q1, below expectation of 0.7% qoq. While Kiwi remains the second strongest major currency for the month, it’s overtaken by Aussie. AUD/NZD’s strong rebound confirms short term bottoming at 1.0389 and further rise would be seen. Focus is back on 1.0608 resistance. As long as this resistance holds, we’re holding on to the view that consolidation from 1.0234 has completed at 1.1017 and deeper fall is expected through 1.0234 low at a later stage. But firm break of 1.0608 will suggest that stronger rise would be seen back to 1.1017 resistance.

SNB and BoE to watch in European session

SNB and BoE rate decisions are the key events to watch in European session. SNB is expected to keep the Libor target range unchanged at -0.25% to -0.75% today. The central bank will likely maintain its current monetary stance and reiterate its complaint on Franc overvaluation. BoE is widely expected to keep bank rate unchanged at 0.25% and asset purchase target at GBP 435b. Attention will be on voting but after the CPI upside surprise earlier this week, Kristin Forbes will likely continue to vote for a hike. Both central bank announcements could turn out to be non-events.

Also to be released in European session include Swiss PPI, UK retail sales and Eurozone trade balance. In US session, US will release import price index, Empire State manufacturing index, Philly Fed survey, jobless claims, industrial production and NAHB housing market index.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1189; (P) 1.1206 (R1) 1.1228; More….

EUR/USD edged higher to 1.1295 but failed to take out 1.1298 key resistance and retreated. As the pair is staying above 1.1109 near term support, intraday bias remains neutral first. Main focus remains on 1.1298. Decisive break there will carry larger bullish implication and target 1.1615 resistance next. On the downside, break of 1.1109 support will indicate short term topping and rejection from 1.1298. In such case, intraday bias will be turned to the downside for 1.0838 support.

In the bigger picture, the case for medium term reversal continues to build up with EUR/USD staying far above 55 week EMA (now at 1.0922). Also, bullish convergence condition is seen in weekly MACD. Focus will now be on 1.1298 key resistance. Rejection from there will maintain medium term bearishness and would extend the whole down trend from 1.6039 (2008 high). However, firm break of 1.1298 will indicate reversal. In such case, further rally would be seen back to 1.2042 support turned resistance next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | GDP Q/Q Q1 | 0.50% | 0.70% | 0.40% | |

| 1:00 | AUD | Consumer Inflation Expectation Jun | 3.60% | 4.00% | ||

| 1:30 | AUD | Employment Change May | 42.0K | 10.0K | 37.4K | |

| 1:30 | AUD | Unemployment Rate May | 5.50% | 5.70% | 5.70% | |

| 7:15 | CHF | Producer & Import Prices M/M May | 0.00% | -0.20% | ||

| 7:15 | CHF | Producer & Import Prices Y/Y May | 0.90% | 0.80% | ||

| 7:30 | CHF | SNB Sight Deposit Interest Rate | -0.75% | -0.75% | ||

| 7:30 | CHF | SNB 3-Month Libor Lower Target Range | -1.25% | -1.25% | ||

| 7:30 | CHF | SNB 3-Month Libor Upper Target Range | -0.25% | -0.25% | ||

| 8:30 | GBP | Retail Sales M/M May | -0.90% | 2.30% | ||

| 9:00 | EUR | Eurozone Trade Balance (EUR) Apr | 22.4B | 23.1B | ||

| 11:00 | GBP | BoE Rate Decision | 0.25% | 0.25% | ||

| 11:00 | GBP | BoE Asset Purchase Target Jun | 435B | 435B | ||

| 11:00 | GBP | MPC Official Bank Rate Votes | 1–0–6 | 1–0–7 | ||

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–7 | 0–0–8 | ||

| 12:30 | CAD | Manufacturing Shipments M/M Apr | 0.90% | 1.00% | ||

| 12:30 | USD | Import Price Index M/M May | -0.10% | 0.50% | ||

| 12:30 | USD | Empire State Manufacturing Index Jun | 6 | -1 | ||

| 12:30 | USD | Initial Jobless Claims (JUN 10) | 241K | 245K | ||

| 12:30 | USD | Philly Fed Manufacturing Index Jun | 25 | 38.8 | ||

| 13:15 | USD | Industrial Production May | 0.20% | 1.00% | ||

| 13:15 | USD | Capacity Utilization May | 76.80% | 76.70% | ||

| 14:00 | USD | NAHB Housing Market Index Jun | 70 | 70 | ||

| 14:30 | USD | Natural Gas Storage | 106B | |||

| 20:00 | USD | Net Long-term TIC Flows Apr | 37.3B | 59.8B |