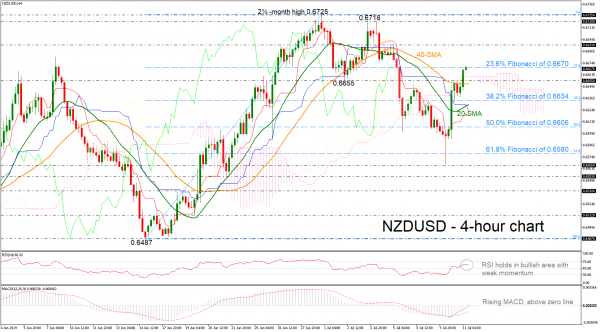

NZDUSD continues to rise above the short-term moving averages, remaining inside the Ichimoku cloud, stretching its upward movement near the 23.6% Fibonacci retracement level of the upward wave from 0.6487 to 0.6725.

According to the MACD, positive momentum could stretch into the short-term as the indicator picks up steam above its trigger line. The RSI is also hovering in the positive area but is flattening.

In the positive scenario, where the price peaks above today’s high of 0.6670, a new top could be formed around the 0.6693 resistance level, which coincides with the upper surface of the Ichimoku cloud. If the market manages to overcome that area, traders could look for obstacle near the 0.6718 – 0.6725 zone.

A reversal to the downside, could immediately stop around the 40-simple moving average (SMA) currently at 0.6655. Further down, the 38.2% Fibo of 0.6634 could also provide support.

To sum up, the short-term risk is looking bullish at the moment.