- Powell’s testimony awaited as investors seek clues on rates following mixed data

- US dollar continues to advance higher as odds of 50 basis points cut are erased

- Pound and aussie extend declines on rising rate cut expectations

Markets are praying for a dovish Powell

Fed Chairman Jerome Powell’s testimony will be today’s and the week’s focal point as investors attempt to gauge how dovish policymakers will be when they meet for their next policy meeting on July 30-31. Expectations that the Federal Reserve will begin an aggressive easing cycle had been running high until last Friday’s stronger-than-expected jobs reports, which dashed hopes of a 50bps cut at the July meeting.

Nevertheless, traders think a 25-bps rate reduction is a certainty in July, though recent remarks from some Federal Open Market Committee (FOMC) members have been on the cautious side. Philadelphia Fed President Patrick Harker yesterday said there was no “immediate need” for a rate cut in an interview with the Wall Street Journal.

Powell’s hearing before the House Financial Services Committee will start at 14:00 GMT and investors expect to get clearer signals from the Fed chief on the extent and pace of rate reductions in the coming months. If Powell indicates the Fed is likely to only make an “insurance” cut in July in a pre-emptive move to soften the impact of a potential sharp slowdown in the US economy, this would lead to further unwinding of bets that there will be at least a 75 bps rate cut over the next 12 months.

The minutes of the Fed’s June’s policy meeting, due at 18:00 GMT, should provide investors additional clues on whether a majority of FOMC members are likely to vote for a rate cut at this month’s meeting.

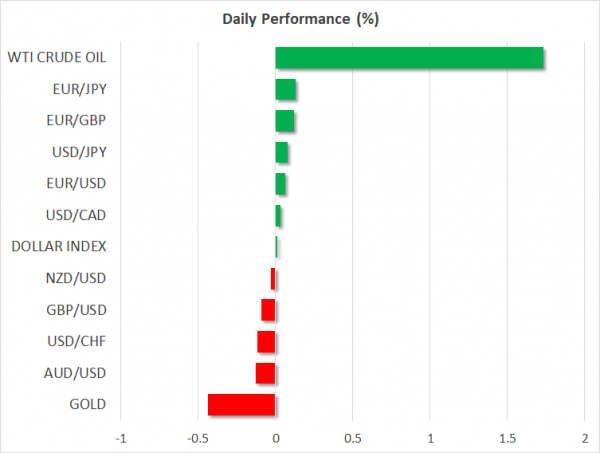

Dollar inches higher ahead of Powell

US Treasury yields extended their recovery on Wednesday, with the 10-year yield climbing to a three-week high of 2.098% on ebbing expectations of large rate cuts by the Fed. The rebound in yields has been helping the greenback to pull back from the lows it plumbed at the end of June when it fell below the 107-yen level. It has since reclaimed the 108 level and is on the verge of breaking above the 109 handle.

The dollar’s quick turnaround has been crushing, however, for other majors. The euro briefly dipped below the $1.12 yesterday as investors bet that the incoming ECB President, Christine Lagarde, will push for looser monetary policy in the Eurozone.

Stocks have also come under pressure but signs of some progress in US-China trade talks capped losses in Asia today. The White House’s chief economic advisor, Larry Kudlow, said the phone conversation between US and Chinese negotiators was “constructive” and that a face-to-face meeting could be arranged soon.

Aussie extends slide, pound struggles to halt decline

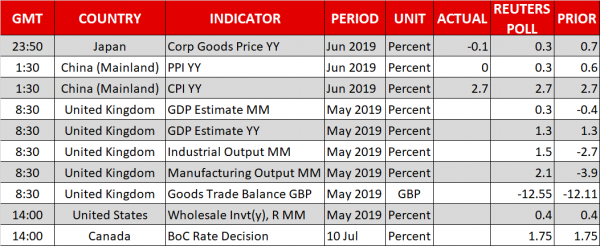

The Australian dollar slid to near three-week lows, approaching the key $0.69 level, as data out of China and Australia disappointed. Chinese producer prices missed expectations of an annual 0.3% gain, to stay unchanged in June, raising concerns about a further deterioration in demand for factory goods. Meanwhile, a closely watched barometer for consumer confidence in Australia fell to a two-year low, suggesting the RBA will need to cut rates again in the coming months to support the economy.

There’s also growing expectations that the Bank of England could soon join others in cutting rates and UK data due later today could confirm that the economy is weakening. The pound has fallen sharply on these expectations, tumbling to six-month lows.

Brexit uncertainty has also been weighing on the pound with little support from recent potentially positive developments. The UK’s opposition Labour party said on Tuesday they now formally back a second referendum, while MPs voted in favour of a bill that would complicate any attempt by the next prime minister to suspend Parliament in a bid to force through a no-deal Brexit.

Bank of Canada to stand pat

The Bank of Canada will announce its latest policy decision at 14:00 GMT today, and while the announcement could get overshadowed by Powell’s testimony, the decision could prove crucial for the loonie. The Canadian dollar recently scaled 8-month highs against the greenback but whether the rally resumes will depend on what the BoC signals about future policy. Should the BoC provide any indication that it is worried enough about the global growth picture to consider cutting rates in the future, it will be difficult for the loonie to resume its uptrend.