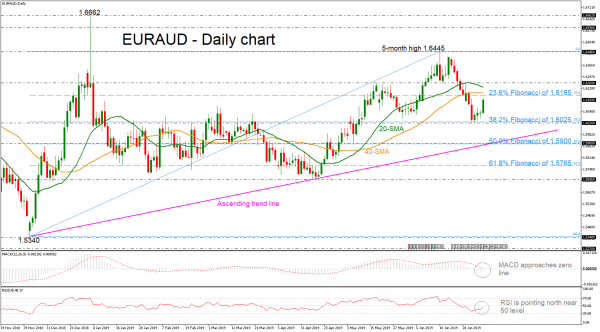

EURAUD finally reversed to the upside last Thursday after printing higher lows and higher highs in the preceding seven months to reach a five-month high of 1.6445 on June 18. Momentum indicators in the daily chart though are currently supporting that positive momentum is likely to strengthen in the short-term. Specifically, the RSI is picking up speed near 50 and the MACD is trying to surpass the zero line.

Further advances could then target the immediate area around the 23.6% Fibonacci retracement level of the bullish rally from 1.5340 to 1.6445 around 1.6185. Marginally above this level, the 40- and then the 20-simple moving averages at 1.6200 and 1.6237 could come in focus before the market challenges the 1.6260 resistance. Such move could also post a clear step higher, hitting the five-month high of 1.6445.

On the other hand, a decline could meet the 38.2% Fibo of 1.6025 and the 1.6020 support again. Below that, the 1.5900 psychological level is standing near the uptrend line, which encapsulates the 50.0% Fibonacci. If there is a successful drop below this handle, this would shift the bullish outlook to neutral, meeting the 61.8% Fibo of 1.5765.

In brief, EURAUD has been advancing over the last days and investors should be waiting for a jump above the short-term moving averages in the daily timeframe.