It will be a pivotal week for the dollar. Fed chief Jay Powell will testify before Congress on Wednesday at 14:00 GMT, and the minutes from the latest FOMC meeting will be released at 18:00 GMT. The nation’s inflation data for June will follow on Thursday at 12:30 GMT. The risks around the dollar seem tilted to the upside this week, as Powell may push back against expectations for a July rate cut. Overall though, the outlook for the greenback remains gloomy.

The latest US payrolls report was strong enough to dispel expectations for an aggressive ‘double’ rate cut of 50 basis points (bps) in July, but markets remain convinced the Fed will still slash rates by a ‘regular’ 25 bps. In fact, that move is fully priced in already, as trade uncertainty and a darkening global outlook are seen as sufficient factors for policymakers to act, even if the US economy doesn’t appear to be in dire need of monetary stimulus.

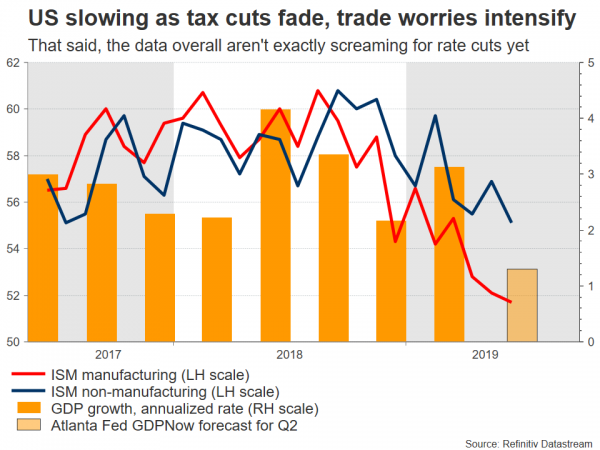

To be fair, some indicators have indeed lost steam – for example inflation has been running a little below the 2% target, and manufacturing surveys show that tariffs have started to bite. Meanwhile, the Atlanta Fed GDPNow model projects annualized growth of only 1.3% in Q2, which marks a sharp slowdown from the 3.1% in Q1. Still, the data as a whole aren’t exactly screaming for rates to be lowered immediately, as most parts of the economy – and especially the consumer – remain healthy.

This generates an upside risk for the dollar this week. Fed Chairman Powell will appear before the House Financial Services Committee on Wednesday for his semiannual testimony, and the risk is that he pushes back against the market’s exceedingly dovish expectations by signaling that a July rate cut is not necessarily a done deal.

To be clear, this is a low probability but high impact outcome. After the June meeting Powell said: “an ounce of prevention is worth more than a pound of cure”, which clearly shows he is in favor of a precautionary rate cut. Yet, one cannot ignore that developments since then have been positive, with decent incoming data and a trade ceasefire. The point is that if Powell wants to keep any optionality about not cutting in July, this is his last chance.

The minutes of the Fed’s June meeting will be released a few hours later, but since that gathering took place before the strong payrolls data was released, the minutes may be seen as outdated. Similarly, even though the Fed chief will testify on Thursday too, this time before the Senate, his prepared remarks will be identical so if there is any action it will come from the subsequent Q&A session with lawmakers.

Perhaps attracting more attention on Thursday will be the CPI inflation data for June. Headline inflation is expected at 1.6% in yearly terms, slower than the 1.8% in May, while the core rate is projected unchanged at 2.0%. These figures will be among the final pieces of the puzzle ahead of the July meeting, elevating their importance.

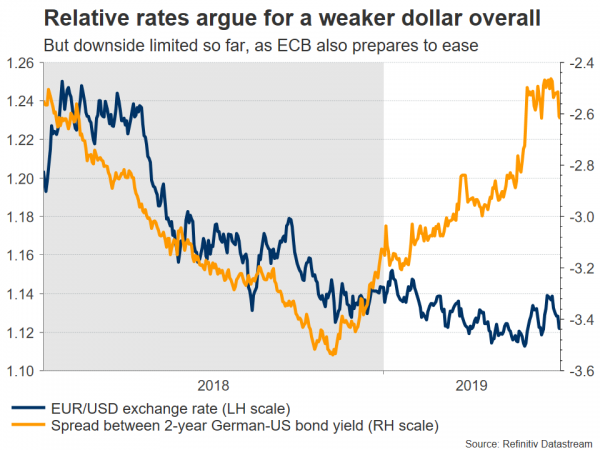

In the big picture, even if the dollar recovers a little further this week, the currency’s broader outlook remains bleak. If central banks indeed start easing as aggressively as markets expect in the coming months, the greenback may be among the biggest losers by virtue of the Fed having much more room to cut rates than any of its peers – eroding the currency’s carry appeal.

Beyond the greenback, stocks could also move. If the prospect of a July cut indeed comes into doubt, that would likely push equities lower in the short term.

Note that on Thursday, besides Powell, we will also hear from the Fed’s Williams, Bostic, Quarles, and Kashkari.

Taking a technical look at dollar/yen, a clear break above the 109.00 area could open the way for a test of 110.70 initially, the May 21 high.

On the flipside, another wave of declines could stall first near 107.50, the July 3 low. Even lower, attention would turn to the June trough of 106.75.