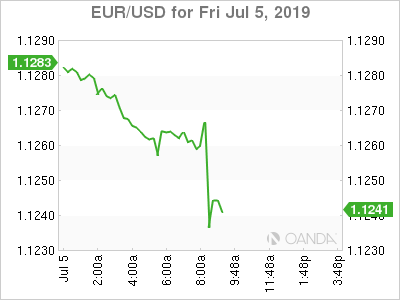

Today’s non-farm payroll shows labor market is still getting tighter despite the unemployment rate ticking higher from the 49-year low as the participation rate rose. Trade tensions are not really hitting the labor market yet, but lack of international investment in the US will eventually hit the data points. The Fed never makes a decision off of one economic data point and the narrative remains inflation is subdued, and global growth concerns are heightened.

Despite the strong rebound in jobs and steady wages, the Fed will still likely deliver a 25-basis point insurance cut at the end of the month. For the Fed to consider a 50 basis point cut, we will need to see the July 26th second quarter advance GDP reading deliver a sub-2% reading.

The dollar rallied across the board and the 10-year Treasury yield extended its gains above 2.00%. Manufacturing, Services and construction all showed strength and that should ultimately support the argument to remain with US equities.

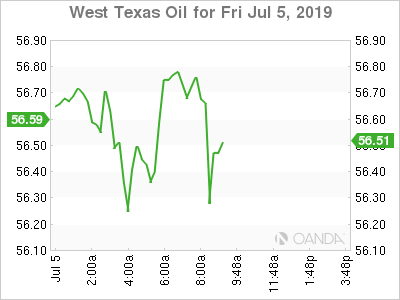

Oil

The fluctuations post non-farm payroll will do little to disrupt the overall trend of slower economic activity globally. The US consumer weekly earnings growth held steady and that is a bright spot for oil as consumption is not seen as collapsing.

The effects of OPEC led production cuts are waning, likely suggesting this is the last cut we will see from the 24-oil producing countries. It is difficult to muster up an argument for higher prices in the short-term, US production is still on an upward trajectory, global demand is falling and geopolitical risk are likely to be sold into.

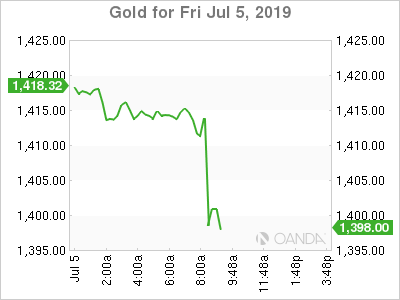

Gold

Gold prices plummeted back towards $1,400 an ounce following the better than expected labor report. The US economy rebounded strongly after last month’s eye-dropping miss. The yellow metal will likely find buyers as the global growth slowdown should keep demand strong for gold.

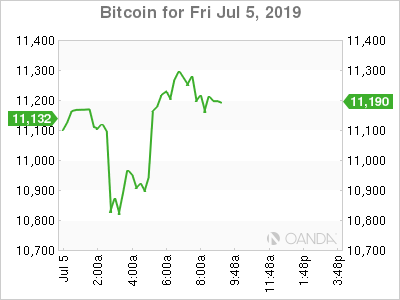

Bitcoin

Bitcoin is down modestly following the Asia Blockchain Summit in Taipei which showed cryptocurrency fans are reinvigorated and are seeking more volatility with increased leverage trading. While digital coin enthusiasts want more extreme trading conditions, this is not what mainstream commerce and institutional investors want to see. Volatility may attract some new investors, but if Bitcoin wants to see stability and a path towards fresh record highs, volatility needs to slow down.

Much of the recent rally was attributed to the excitement of Facebook’s launch of their own stablecoin, Libra. While Libra is a long way from being used, it will try to overtake Bitcoin, a task many altcoins have failed with.