The Canadian employment data for June will hit the markets on Friday at 12:30 GMT. Forecasts point to a relatively soft report, which if confirmed, could take some shine off the loonie. In the big picture though, the outlook for the currency remains bright, as the Bank of Canada (BoC) may be the only major central bank that won’t cut rates soon.

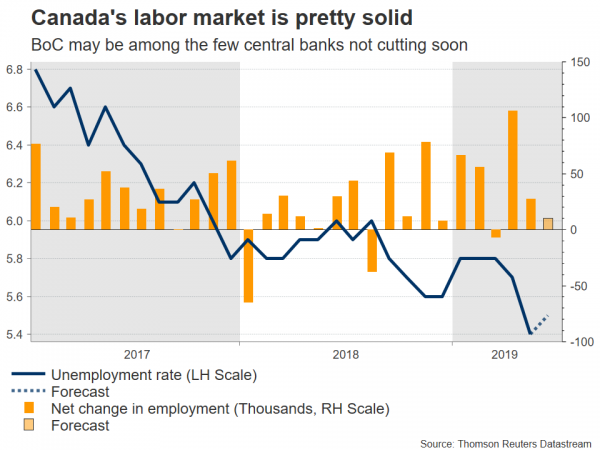

The Canadian economy has been an oasis of strength lately, even as the data pulse in most other major economies has weakened. Inflation is above the midpoint of the BoC’s target range, the labor market is tight, and most indicators suggest that growth picked up in Q2 after a soft start to the year. Accordingly, the BoC’s latest business survey painted a more positive picture, with firms expecting stronger sales growth, while home prices also stabilized in May following a streak of declines.

This strength is all the more impressive when one considers that the threat of protectionism still hangs in the background, likely holding back investment by firms and therefore constraining economic growth. The bottom line is that if the economy remains solid, the BoC may soon find itself as the only major central bank that isn’t easing policy, which would make the loonie much more attractive from a relative interest rates viewpoint.

Hence, the upcoming employment data could be crucial in shaping this narrative. In June, the unemployment rate is forecast to have ticked up to 5.5%, from a four-decade low of 5.4%. Meanwhile, the net change in employment is expected at 10.0k, less than the 27.7k in May, but still a positive number.

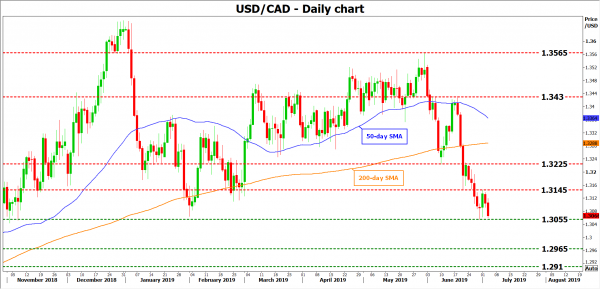

As for the market reaction, if the actual prints are even weaker than anticipated, that could ignite some expectations for BoC rate cuts and therefore hurt the loonie a little on the news. Taking a technical look at dollar/loonie, advances may stall initially near 1.3145, the June 20 low, with an upside break opening the way for a test of 1.3225.

On the other hand, a stronger-than-expected data set may add credence to the narrative that the BoC will be an ‘island of neutrality’, pushing the loonie higher. A potential break below 1.3055 would mark a fresh low for this year, turning the focus to 1.2965, the trough of October 24, 2018.

Note that the US employment data for the same month will be released at the same time, so the reaction in the pair will probably depend on those too.

Overall, the risks increasingly seem tilted towards a stronger loonie. Even in case dollar/loonie rebounds this week, perhaps if the American data are strong enough to dispel some expectations for aggressive Fed easing in July for example, that could be only a temporary reprieve before the next wave lower. The bigger story is still that of monetary policy divergence between the Fed and BoC, and until that changes, there may not be much that can stand in the loonie’s way.