US markets regained strength overnight with DOW and S&P 500 closed at record highs as selloff in tech stocks stabilized. DOW gained 92.8 pts, or 0.44% to end the day at 21328.47. S&P 500 rose 10.96 pts, or 0.45% to close at 2440.35. However, no strength was seen in treasury yields as 10 year yield lost -0.006 to close at 2.207, staying well below 2.297 resistance and maintains near term bearish outlook. In the currency markets, Canadian Dollar remains the strongest one as boosted by hawkish twist in BoC officials’ rhetorics. Meanwhile, Dollar is trading as the weakest major currency for the week. The development argues that traders could be quite concerned with a dovish FOMC hike today.

Fed to hike but focus on projections and vote

FOMC meeting is the major focus of the day. Fed is widely expected to raise the federal fund rate by 25bps to 1.00-1.25%. Markets are pricing in near 100% chance of that and there is little chance for Fed to give us a surprise there. But traders are very cautious as it’s now getting more unsure on whether Fed will hike again in September. The new economic projections to be released today will probably hold the first key to this. The vote split for today’s decision will be another hint on how divided the committee is regarding the economic outlook. Fed chair Janet Yellen will likely release more information on Fed’s plan to shrink its balance sheet too.

Dollar selling might accelerate if EUR/USD breaks 1.13 firmly

Technically, dollar is staying generally bearish except versus Sterling. EUR/USD is holding above 1.1109 support and is mildly in favor to take out 1.1298 key resistance, which would carry larger bullish implications. USD/JPY is holding below 111.70 resistance, which suggests that fall from 114.36 is still in progress for 108.12 and below, to extend the larger decline from 118.65 (Dec high). USD/CAD breached 1.3222 key support level which now further affirms the case of medium term reversal and puts1.3 handle into focus. Overall, the greenback will be vulnerable if Fed hints at a rate path that is slower than originally planned. And a strong break of 1.13 in EUR/USD could trigger accelerated selloff in the greenback.

PM May said Brexit negotiation to start next week

In UK, Prime Minister Theresa May confirmed that the negotiation with EU on Brexit will formally start on January 19 as originally planned. May announced while she was meeting with French President Emmanuel Macron that "the timetable for the Brexit negotiation remains on course and will begin next week." And she emphasized that "we have been very clear we want to maintain a close relationship and a close partnership with the EU and individual member states into the future, including in the areas we’ve discussed this evening."

While the negotiation may really start next week, UK’s stance on it is still very unclear after last week’s election. There were calls for a multi-party negotiation team and a softer Brexit approach. Meanwhile, Labour has indicated that they will not agree a Brexit consensus with the Conservatives until May ditches her "no deal is better than a bad deal" rhetoric.

On the data front

China industrial production rose 6.5% yoy in May, fixed assets investments rose 8.6% yoy, retail sales rose 10.7% yoy. Japan industrial production was finalized at 4.0% mom in April. Australia Westpac consumer confidence dropped -1.8% in June. New Zealand current account balance turned into NZD 0.24b surplus in Q1.

German CPI was finalized at -0.2% mom, 1.5% yoy in May. UK employment data will be a key focus in European session. Sterling will look into the data for more upside momentum while traders await tomorrow’s BoE announcement. Eurozone will release industrial production and employment.

While FOMC rate decision and press conference is the major focus, Dollar will first face the test of CPI in early US session. Retail sales and business inventories will also be released.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3193; (P) 1.3259; (R1) 1.3306; More….

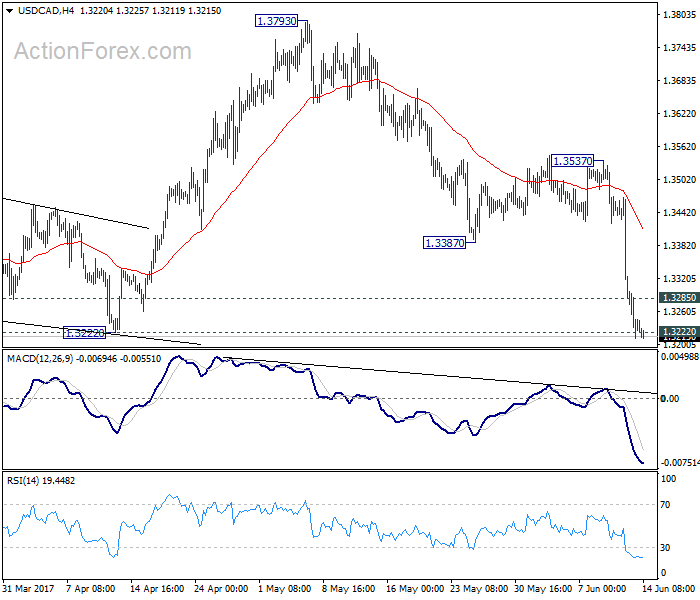

USD/CAD drops further to as low as 1.3211 so far as the decline from 1.3793 extends. Intraday bias remains on the downside with focus on 1.3222 support, which is close to medium term channel support. As noted before, we’re holding on to the view that whole choppy rise from 1.2460 has completed at 1.3793. Decisive of 1.3222 will affirm our bearish view and target 1.2968 key support for confirmation. On the upside, above 1.3285 minor resistance will turn bias neutral and bring recovery. But upside should be limited by 1.3387/3537 resistance zone to bring another decline.

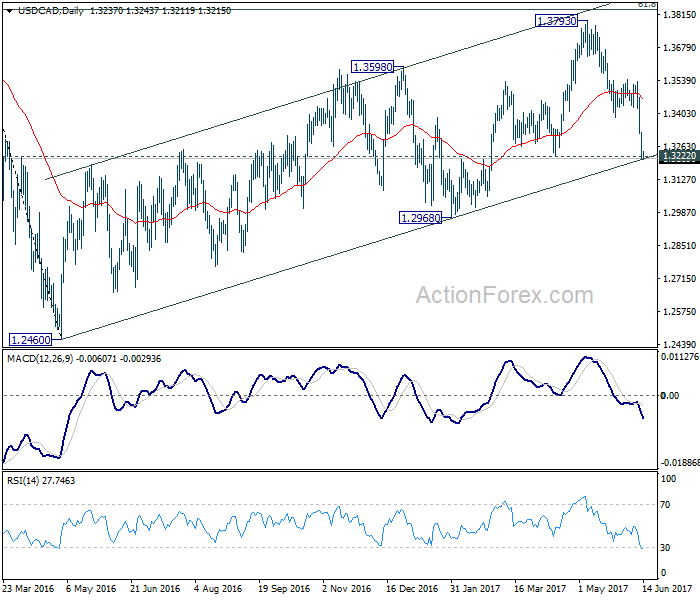

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. Rise from 1.2460 is seen as the second leg and could have completed at 1.3793, ahead of 61.8% retracement of 1.4689 to 1.2460 at 1.3838. Break of 1.3222 should indicate the start of the third leg while further break of 1.2968 should confirm. In that case, USD/CAD should decline through 1.2460 support to 50% retracement of 0.9406 to 1.4869 at 1.2048.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Current Account Balance Q1 | 0.24B | 1.00B | -2.34B | -2.42B |

| 0:30 | AUD | Westpac Consumer Confidence Jun | -1.80% | -1.10% | ||

| 2:00 | CNY | Retail Sales Y/Y May | 10.70% | 10.80% | 10.70% | |

| 2:00 | CNY | Fixed Assets Ex Rural YTD Y/Y May | 8.60% | 8.80% | 8.90% | |

| 2:00 | CNY | Industrial Production Y/Y May | 6.50% | 6.50% | 6.50% | |

| 4:30 | JPY | Industrial Production M/M Apr F | 4.00% | 4.10% | 4.00% | |

| 4:30 | JPY | Capacity Utilization M/M Apr | 4.30% | -1.60% | ||

| 6:00 | EUR | German CPI M/M May F | -0.20% | -0.20% | -0.20% | |

| 6:00 | EUR | German CPI Y/Y May F | 1.50% | 1.50% | 1.50% | |

| 8:30 | GBP | Jobless Claims Change May | 10.0K | 19.4K | ||

| 8:30 | GBP | Claimant Count Rate May | 2.30% | |||

| 8:30 | GBP | ILO Unemployment Rate 3M Apr | 4.60% | |||

| 8:30 | GBP | Average Weekly Earnings 3M/Y Apr | 2.40% | 2.40% | ||

| 9:00 | EUR | Eurozone Industrial Production M/M Apr | 0.50% | -0.10% | ||

| 9:00 | EUR | Eurozone Employment Q/Q Q1 | 0.30% | 0.30% | ||

| 12:30 | USD | CPI M/M May | 0.00% | 0.20% | ||

| 12:30 | USD | CPI Y/Y May | 2.00% | 2.20% | ||

| 12:30 | USD | CPI Core M/M May | 0.20% | 0.10% | ||

| 12:30 | USD | CPI Core Y/Y May | 1.90% | 1.90% | ||

| 12:30 | USD | Advance Retail Sales May | 0.10% | 0.40% | ||

| 12:30 | USD | Retail Sales Less Autos May | 0.20% | 0.30% | ||

| 14:00 | USD | Business Inventories Apr | 0.30% | 0.20% | ||

| 14:30 | USD | Crude Oil Inventories | 3.3M | |||

| 18:00 | USD | FOMC Rate Decision | 1.25% | 1.00% |