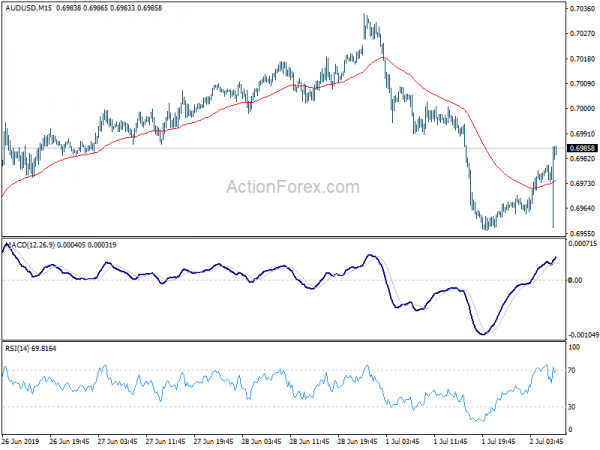

Australian Dollar recovered earlier today ahead of RBA rate decision. Some knee-jerk reactions were seen after RBA announced the highly anticipated 25 bps rate cut to 1.00%. But AUD/USD quickly found its footing as the accompanying statement revealed nothing special, and doesn’t indicate a drastic dovish turn. While RBA opens the door for more rate cut ahead, upcoming developments, including new economic projections in August, would play an important part in deciding when the next cut would be delivered.

The most important part of the statement is that “the Board will continue to monitor developments in the labour market closely and adjust monetary policy if needed to support sustainable growth in the economy and the achievement of the inflation target over time”. It’s self-explanatory that RBA is open to further easing.

Globally, RBA maintained that outlook “remains reasonable”. Domestically, RBA acknowledged the below trend 1.8% growth in Q1. But it noted that “central scenario for the Australian economy remains reasonable, with growth around trend expected.” Consumption continues to be the main domestic uncertainty”.

Employment growth has “continued to be strong”. But again, ” labour market outcomes suggest that the Australian economy can sustain lower rates of unemployment and underemployment.” Inflation pressures “remain subdued”. But inflation is expected to pick up to “around 2 per cent in 2020 and a little higher after that”. On the positive side, RBA noted t some tentative signs that houses prices are “now stabilizing” in Sydney and Melbourne.