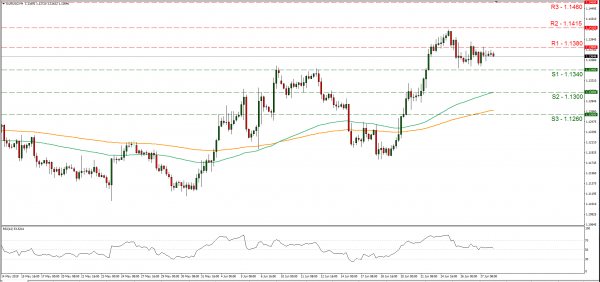

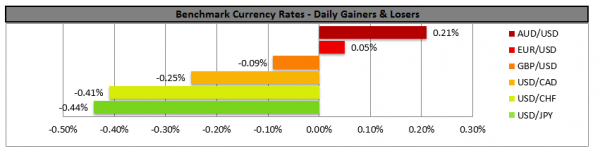

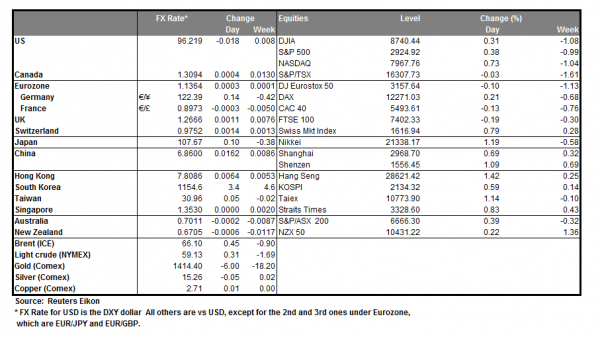

The USD remained rather stable yesterday, as expectations about the G20 meeting are flooding the markets. Market participants eye especially the Trump-Xi meeting, as it could render a breakthrough to the current impasse of the US-Sino relationships. Chinese media reported that the two countries were laying out an agreement that would help avert the next round of tariffs on US imports from China. Analysts on the other hand tend to be more on the cautious side, as any result seems to be quite uncertain currently. Please note that should there be any signs of progress in the US-Sino relationships, we could see the AUD and the USD getting some support. On the flip side, should the end result of the meeting fail the markets, we may experience a disproportional reaction of the markets, weakening the USD. EUR/USD maintained a sideways motion yesterday, between the 1.1380 (R1) resistance line and 1.1340 (S1) support line. We maintain the view for the pair to keep its current direction, yet the G20 meeting could provide substantial fundamentals for the pair to alter its course. Should the bulls take over the pair’s direction, we could see it breaking the 1.1380 (R1) resistance line and aim for the 1.1415 (R2) resistance level. Should the bears take over, we could see the pair breaking the 1.1340 (S1) support line and aim for the 1.1300 (S2) support level.

Easy come, easy go for Bitcoin

Bitcoin relented most of the gains made last week within one day’s session, yesterday. Analysts note that Bitcoin reversed course after a prominent cryptocurrency exchange reported an outage, yet we remain skeptical if the fundamentals are sufficient for such a drop. On other news, an Asian crypto exchange shut down and anther one was hacked, with 4 million worth of assets being reportedly stolen. Please bear in mind that Bitcoin, started its latest rise after a number of large organizations and especially Facebook, showed signs of some form of adoption of cryptocurrencies. We expect volatility to be maintained over the short term with both directions being possible. Bitcoin dropped heavily yesterday, breaking consecutively the 12360 (R2) and the 11580 (R1) support lines, now turned to resistance and at some point temporarily the 11000 (S1) support line. We see the drop as a correction lower, yet would not be surprised to see the crypto currency rising again. For the time being, as the crypto’s price action broke the upward trendline incepted since the 20th of June, we switch our bullish bias in favor of a sideways scenario. Should Bitcoins long positions be favored once again from the market, we could see the crypto’s value rising and breaking the 115800 (R1) resistance line and aim for the 12360 (R2) resistance hurdle. Should the bears take over, we could see the pair breaking the 11000 (S1) support line once again and aim for the 10400 (S2) support barrier.

Other economic highlights today and early tomorrow

Today during the European session, we get France’s preliminary CPI (EU Normalised) rate for June, UK’s final GDP growth rate for Q1 and Eurozone’s preliminary CPI rate for June. In the American session, we get Canada’s GDP rate for April and from the US the Eurozone’s industrial sentiment and business climate indicators, both for June. Later on, we get Germany’s preliminary HICP rate for June. In the American session, we get the final US GDP growth rate for Q1 as well as the US the personal consumption rate for May, the Core PCE price index for May, the final Michigan consumer Sentiment for June and later on the Baker Hughes oil rig count. In the early hours on Sunday, China’s NBS manufacturing PMI for June is due out. On Monday during the Asian session, we get the Caixin Manufacturing PMI for June and Japan’s Tankan large manufacturers Index for Q2.

Bitcoin H4

Support: 11000 (S1), 10400 (S2), 9500 (S3)

Resistance: 11580 (R1), 12360 (R2), 13000 (R3)

Support: 1.1340 (S1), 1.1300 (S2), 1.1260 (S3)

Resistance: 1.1380 (R1), 1.1415 (R2), 1.1460 (R3)