The New Zealand dollar rose after the central bank delivered its interest rates decision. The bank left interest rates unchanged at 1.50% as was widely expected. As with the other central banks, officials warned that a rate cut would be necessary to stimulate the economy and caution from adverse economic risks. This rate decision came a day after the country’s statistics office reported that exports and imports had increased in May, leading to a higher trade surplus. The monetary statement said:

We expect low-interest rates and increased government spending to support a lift in economic growth and employment. Inflation is expected to rise to the 2 percent mid-point of our target range, and employment to remain near its maximum sustainable level.

The price of crude oil rose in overnight trading as investors continued their focus on the Iran and Washington tensions. In a tweet yesterday, Donald Trump threatened to obliterate Iran, if it dared to attack any American interests. He also blamed the country for its continued support of terror organizations in the Middle East. Investors also focused on the US inventories data released by the American Petroleum Institute (API). Data showed that in the past week, the inventories decreased by more than 7.55 million barrels. Later today, EIA data is expected to show that inventories declined by more than 2.45 million barrels.

Wall Street ended the day lower after Jerome Powell warned that the economy was facing significant headwinds. While he did not say it, the Fed Chair speech implied that members could slash interest rates in the July meeting. This will be the first meeting in more than ten years from the Fed. Historically, a recession happens shortly after the Fed starts the cycle of lowering interest rates. Investors were also reacting to the home sales data released yesterday. The number showed that the new home sales in May were at more than 626k, which was lower than April’s 679k. This was a 7.9% decline and the fourth straight month of declines. Later today, the US will release durable goods data.

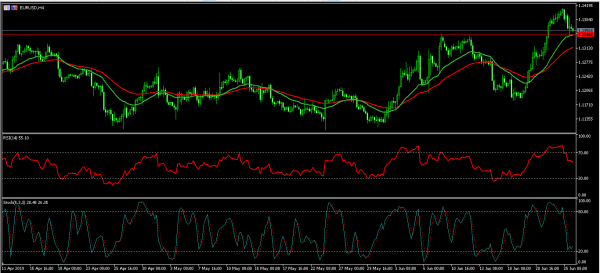

EUR/USD

The EUR/USD pair was relatively unmoved in the Asian session. The pair is trading at 1.1356, which was slightly higher than yesterday’s low of 1.1345. On the hourly chart, the pair is slightly above the 25-day and 50-day moving averages. It is also slightly above the important support of 1.1345 reached yesterday. The RSI has moved from a high of 81 to the current 45 while the signal line of the stochastic indicator is close to the oversold level. The pair will likely resume the upward trend ahead of the durable goods data.

XBR/USD

The price of crude oil continued to rise after inventory data from the EIA. The pair reached a high of 65.15, which is along the 38.2% Fibonacci Retracement level. It is also above the 25-day and 50-day moving averages while the RSI has moved close to the overbought level. It’s likely that the pair will test the important resistance level of 66.85, which is also the 50% Fibonacci Retracement level.

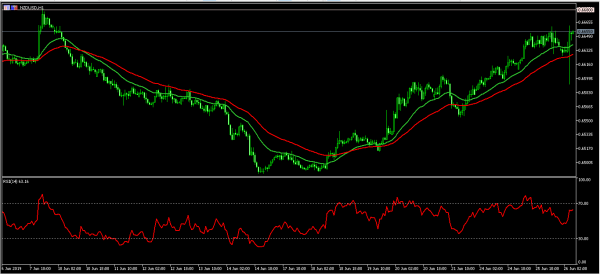

NZD/USD

The NZD/USD pair initially fell after a dovish statement by the RBNZ. It reached a low of 0.6592 and then started to move higher, reaching a high of 0.6660. On the hourly chart, the pair is trading above all the short and medium-term moving averages. It is also forming a cup and handle pattern. The RSI has moved to almost the overbought level of 70. The pair will likely continue moving higher until it tests the important resistance level of 0.6680.