Dollar rebounds notably after St Louis Fed President James Bullard, the most dovish Fed official, dismissed a 50bps rate cut in July, in a Bloomberg interview. He said “just sitting here today I think 50 basis points would be overdone. And, “I don’t think the situation really calls for that but I would be willing to go to 25. Though, Bullard emphasized that ” I hate to pre-judge meetings – things can change by the time you get there – but if I was just going today that’s what I would do.”

Separately, Fed Chair Jerome Powell emphasized Fed’s independence in a prepared speech. He said “the Fed is insulated from short-term political pressures—what is often referred to as our ‘independence.’ Congress chose to insulate the Fed this way because it had seen the damage that often arises when policy bends to short-term political interests. Central banks in major democracies around the world have similar independence.”

On the economy, Powell said “the baseline outlook of my FOMC colleagues, like that of many other forecasters, remains favorable”. But inflation would return to target “at a somewhat slower pace than we foresaw earlier in the year.” And, ” risks to this favorable baseline outlook appear to have grown.” Hence, Fed will now “closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion.”

Powell also emphasized “we are also mindful that monetary policy should not overreact to any individual data point or short-term swing in sentiment. Doing so would risk adding even more uncertainty to the outlook.”

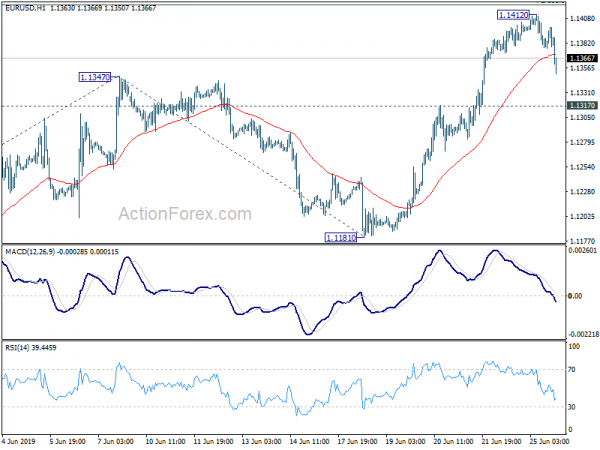

EUR/USD’s retreat from 1.1412 temporary top extends lower after the comments. But for now, as long as 1.1317 minor support holds, further rise is still in favor.