Key Highlights

- The British Pound struggled again to surpass the 1.2760 resistance against the US Dollar.

- GBP/USD remains supported on dips near the 1.2680 and 1.2665 levels.

- The Chicago Fed National Activity Index in June 2019 increased from -0.48 to -0.05.

- The US Consumer Confidence in June 2019 might decrease from 134.1 to 131.2.

GBPUSD Technical Analysis

This past week, the British Pound started a solid upward move above 1.2600 against the US Dollar. The GBP/USD pair even broke the 1.2660 resistance level to move into a positive zone.

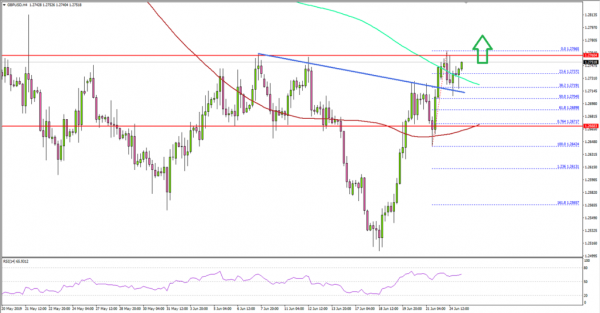

Looking at the 4-hours chart, the pair even surpassed the 1.2700 resistance and settled well above the 100 simple moving average (red, 4-hours). However, the pair ran into a crucial resistance at 1.2760, which acted as a hurdle for buyers on many occasions earlier.

A swing high was formed at 1.2766 and the pair recently corrected lower below 1.2740. It traded close to the 50% Fib retracement level of the upward move from the 1.2642 low to 1.2766 high.

If there is a break below the 1.2700 support, the pair could correct further towards the 1.2680 support. However, the main support is near the 1.2665 level and the 100 simple moving average (red, 4-hours).

As long as there is no close below 1.2660 and the 100 SMA, GBP/USD is likely to find fresh bids and it could bounce back in the near term.

On the upside, the main resistance is near the 1.2760, above which the pair could surge towards the 1.2800 or 1.2840 level.

Fundamentally, the Chicago Fed National Activity Index for June 2019 was released by the Federal Reserve Bank of Chicago. The market was looking for a minor increase from -0.45 to -0.34.

The actual result was better than the market forecast, as the Chicago Fed National Activity Index increased to -0.05. On the other hand, the last reading was revised down from -0.45 to -0.48. Therefore, the overall increase was much more than the market expected.

The report added:

Three of the four broad categories of indicators that make up the index increased from April, but only one of the four categories made a positive contribution to the index in May.

Overall, EUR/USD and GBP/USD are showing a lot of positive and any dips are likely to find buyers in the coming sessions.

Economic Releases to Watch Today

- US Housing Price Index April 2019 (MoM) – Forecast +0.2%, versus +0.1% previous.

- S&P/Case-Shiller Home Price Indices April 2019 (YoY) – Forecast +2.6%, versus +2.7% previous.

- US Consumer Confidence June 2019 – Forecast 131.2, versus 134.1 previous.

- US New Home Sales May 2019 (MoM) – Forecast -2.8% versus -6.9% previous.