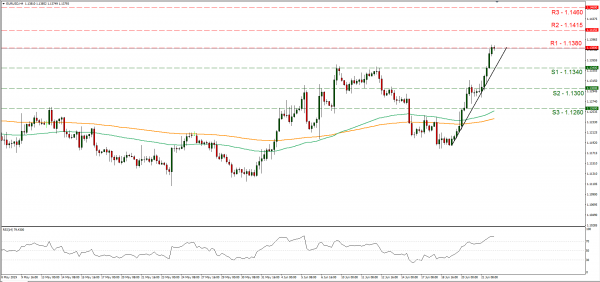

EUR/USD rose on Friday and during today’s Asian session, reaching a three-month high, as the bearish sentiment for the USD continued. The prospect of the Fed’s possible easing scared USD bulls away, weighing on the USD. The comparison of the prospects of the two central banks, ECB and the Fed, continues to provide an advantage for the common currency. On other news there seems to be mobility on the US-Sino trade relationships, as Chinese officials stated that both the US and China should make compromises for the two countries to find a solution. Should worries about the Fed’s expected easing be maintained, we could see the USD weakening further, yet markets could be keeping an eye out for the G20 meeting in Osaka near the end of the week. The pair rallied on Friday breaking the 1.1300 (S2) and the 1.1340 (S1) resistance lines (now turned to support) and continued its rise testing the 1.1380 (R1) resistance level. The pair seems to be finding substantial resistance at the prementioned level, yet as the upward trendline incepted since the 19th of June, has not been broken, we maintain our bullish bias. Please note that the RSI indicator of the 4-hour chart, surpassed the reading of 70, implying a rather overcrowded long position. Should the bulls maintain control over the pair’s direction, we could see it breaking the 1.1380 (R1) resistance line and aim for the 1.1415 (R2) resistance level. Should the bears take over, we could see the pair breaking the 1.1340 (S1) support line and aim for lower grounds.

WTI prices rise as Middle East tensions continue to worry markets.

Oil prices continued to rise during today’s Asian session, as tension stayed at a high level in the Middle East. US Secretary of State Pompeo stated that “significant” sanctions on Tehran would be announced, yet also stated that the US is prepared to negotiate without any preconditions. The sanctions should aim at depriving Persia from resources that the country uses to fund its activities in the region, according to media. Please note that last week, US President Trump stated that he cancelled an airstrike on Iran, yet on Sunday also stated that was not seeking war with Iran. Should tensions remain at a high level and the supply of black gold under threat, we could see WTI prices rise further. WTI prices maintained bullish tendencies on Friday and during today’s Asian session broke the 57.70 (S1) resistance line (now turned to support). We tend to maintain a bullish bias for the pair as long the upward trendline incepted since the 18th of June remains intact. Should the commodity find fresh buying orders along its path, we could see its prices breaking the 59.50 (R1) resistance line. Should WTI come under the selling interest of the market, we could see its prices breaking the 57.70 (S1) support line and aim for the 56.00 (S2) support level. Please note that the RSI indicator in the 4-hour chart is above the reading of 70, implying that the commodity may be overbought.

Other economic highlights, today and early tomorrow

Today during the European session, we get France’s final GDP growth rate for Q1 and Germany’s Ifo Business Climate for June. During tomorrow’s Asian session, we get New Zealand’s trading data for May.

As for the rest of the week:

On Tuesday, we get from the US the CB consumer sentiment for June and Fed Chair Powell speaks. On Wednesday, we get from New Zealand RBNZ’s interest rate decision, from Germany the GfK consumer Sentiment for July, from the Czech Republic CNB’s interest rate decision, and from the US the durable goods orders growth rates for May. On Thursday, we get from Japan the retail sales for May, from Germany the preliminary HICP rate for June and the final US GDP growth rate for Q1. On Friday, we get from Japan, Tokyo’s CPI rates for June and the industrial production for May. From the UK we get the final GDP growth rate for Q1, from the Eurozone the preliminary HICP rate for June and Canada’s GDP for April.

Support: 1.1340 (S1), 1.1300 (S2), 1.1260 (S3)

Resistance: 1.1380 (R1), 1.1415 (R2), 1.1460 (R3)

Support: 57.70 (S1), 56.00 (S2), 54.50 (S3)

Resistance: 59.50 (R1), 61.00 (R2), 62.75 (R3)