Canadian Dollar jumps sharply overnight as boosted by comments from a top BoC official that raises prospect of a rate hike. Senior Deputy Governor Carolyn Wilkins said in a speech that adjustment to lower oil prices was "largely behind us" with help of the rate cuts in 2015. And, there are "encouraging signs" of broadening growth across regions and sectors. Meanwhile, there is "significant monetary policy stimulus in the system". And, she noted that "as growth continues and, ideally, broadens further, Governing Council will be assessing whether all of the considerable monetary policy stimulus presently in place is still required." This is seen by the markets as an indication that the door for further rate cut from the current 0.50% is closed. And the next move would be a hike.

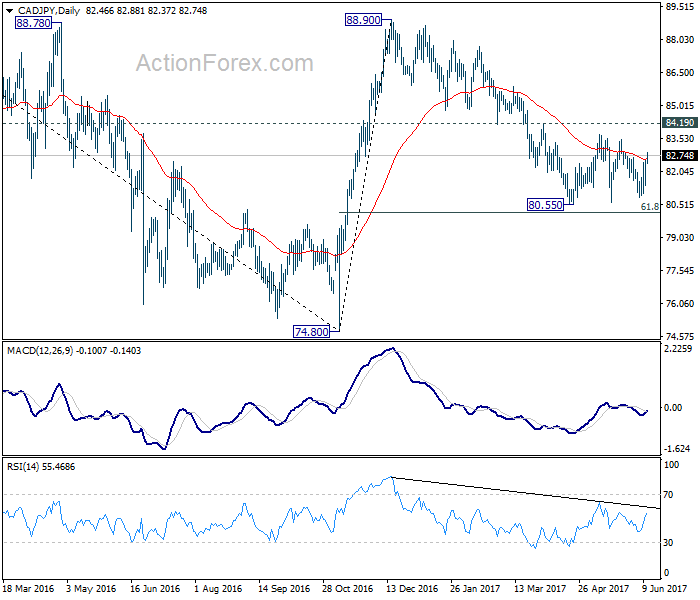

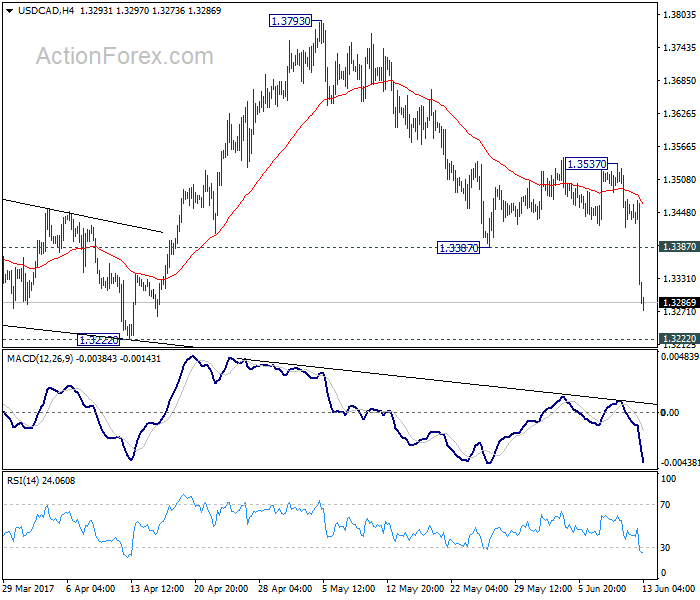

USD/CAD finally resumed recent fall from 1.3793 by breaking 1.3273 so far. The pair should test 1.3222 support in near term. We’re favoring the case of medium term reversal in USD/CAD and break of 1.3222 will affirm our view and target 1.2968 support next. EUR/CAD also drops sharply to as low as 1.4856, comparing to this month’s high at 1.5257. But EUR/CAD has been rather resilience due to strength in Euro. And outlook in EUR/CAD will stay mildly bullish as long as 1.4823 support holds. CAD/JPY also rebounds strongly but it’s held in range above 80.55 short term bottom. Outlook is a bit mixed and we’ll stay neutral on the cross first. Break of 81.49 will indicate near term reversal for 88.90. Meanwhile, break of 80.55 will pave the way to test 74.80 low.

US Treasury recommends over 100 changes to financial regulation

In US, the stock markets some what stabilized. NASDAQ dipped initially to as low as 6110.66 but pared back much losses to close at 6175.46, just down -0.52%. DOW closed down -0.17% at 21235.67 while S&P 500 closed down -0.1% at 2429.39. 10 year yield rose slightly by 0.014 to 2.213 but is kept well below near term resistance at 2.297. It is reported that US President Donald Trump’s Treasury is calling for scaling back some of the post 2008 financial crisis regulations. A near 150-page report was produced and there were recommendations of over 100 changes to financial rules. But the report stopped short of calling for the repeal of the so called Dodd-Franck financial regulation law, which Trump called a "disaster". Treasury Secretary Steven Mnuchin said that the focus of the report was "what are the things that we can do to unlock burdensome regulations and overlapping regulations and work with the regulators?"

Conservative and Labour in private talks for softer Brexit

In UK, it’s reported that Conservative and Labour MPs have met in closed door talks regarding the country’s Brexit negotiation stance. The Cabinet ministers are believed to be trying to secure support from Labour MPs for a softer Brexit that gives UK access to the Single Market. Also, the Parliament would try to assert its maximum influence to shape the negotiation with EU, rather than letting the Government to do it on its now. Meanwhile, some centrist Labours are believed to be willing to put aside party differences to get the best Brexit deal. But in any case, it’s now believed that Prime Minister Theresa May’s "no deal is better than a bad deal" stance won’t be adopted after the disastrous election.

BoJ official said slower bond purchase due to falling yields

In Japan, BoJ’s executive director on monetary policy told the Parliament that the pace of bond purchases slowed since US yields have fallen. Masayoshi Amamiya said that "the slowdown came as a result of our policy of guiding yields at appropriate levels:. And BoJ will "continue to take necessary steps to stabilize prices, while keeping an eye on how they affect its financial health". BoJ will announce monetary policy decision on Friday and it’s widely expected to keep everything unchanged.

On the data front

Japan BSI large industry index dropped to -2.9 in Q2. Australia NAB business confidence dropped to 7 in May. UK CPI will be the major focus in European session. Downside surprise there could build up selling pressure in Sterling again ahead of BoE meeting. Eurozone will also release ZEW economic sentiment. From US, PPI is the only major data release.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3271; (P) 1.3371; (R1) 1.3422; More….

USD/CAD’s decline from 1.3793 resumed by taking out 1.3387 and reaches as low as 1.3273 so far. Intraday bias is back on the downside for 1.3222 support next. We’d holding on to the view that whole choppy rise from 1.2460 has completed at 1.3793. Break of 1.3222 will affirm our bearish view and target 1.2968 key support for confirmation. On the upside, above 1.3387 support turned resistance will turn intraday bias neutral. But recovery should be limited well below 1.3537 resistance to bring fall resumption.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. Rise from 1.2460 is seen as the second leg and could have completed at 1.3793, ahead of 61.8% retracement of 1.4689 to 1.2460 at 1.3838. Break of 1.3222 should indicate the start of the third leg while further break of 1.2968 should confirm. Nonetheless, sustained trading above 1.3838 would pave the way to retest 1.4689 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BSI Large All Industry Q/Q Q2 | -2.9 | 1.5 | 1.3 | |

| 1:30 | AUD | NAB Business Confidence May | 7 | 13 | ||

| 8:30 | GBP | CPI M/M May | 0.20% | 0.50% | ||

| 8:30 | GBP | CPI Y/Y May | 2.70% | 2.70% | ||

| 8:30 | GBP | Core CPI Y/Y May | 2.30% | 2.40% | ||

| 8:30 | GBP | RPI M/M May | 0.30% | 0.50% | ||

| 8:30 | GBP | RPI Y/Y May | 3.50% | 3.50% | ||

| 8:30 | GBP | PPI Input M/M May | -0.40% | 0.10% | ||

| 8:30 | GBP | PPI Input Y/Y May | 13.40% | 16.60% | ||

| 8:30 | GBP | PPI Output M/M May | 0.10% | 0.40% | ||

| 8:30 | GBP | PPI Output Y/Y May | 3.60% | 3.60% | ||

| 8:30 | GBP | PPI Output Core M/M May | 0.20% | 0.50% | ||

| 8:30 | GBP | PPI Output Core Y/Y May | 2.80% | |||

| 8:30 | GBP | House Price Index Y/Y Apr | 3.70% | |||

| 9:00 | EUR | German ZEW (Economic Sentiment) Jun | 21.8 | 20.6 | ||

| 9:00 | EUR | German ZEW (Current Situation) Jun | 83.9 | |||

| 9:00 | EUR | Eurozone ZEW (Economic Sentiment) Jun | 37.2 | 35.1 | ||

| 12:30 | USD | PPI M/M May | 0.00% | 0.50% | ||

| 12:30 | USD | PPI Y/Y May | 2.50% | 2.50% | ||

| 12:30 | USD | PPI Core M/M May | 0.20% | 0.40% | ||

| 12:30 | USD | PPI Core Y/Y May | 2.00% | 1.90% |