The Euro fell sharply (making the biggest hourly drop in 1 1/2 month) and hit new two-week lows as comments from ECB President Draghi disappointed traders.

Draghi pointed to weakness in coming quarters, signaling that fresh stimulus would be required if inflation doesn’t return to the target.

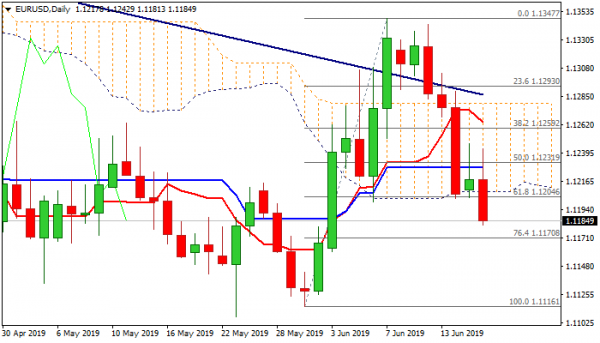

Renewed probe through key supports at 1.1208/04 (daily cloud base/Fibo 61.8% of 1.1116/1.1347) is generating bearish signal which would require confirmation on daily close below these levels.

Massive miss of German ZEW (Jun -21.1 vs -5.7 f/c) and weak EU inflation, added to strong bearish tone, proving negative stance of ECB’s Draghi. The pair hit new low at 1.1181 (the lowest since 3 Jun) and eyes Fibo support at 1.1170 (76.4% of 1.1116/1.1347), with further weakness on bearish sentiment not ruled out. Daily stochastic continues to head south in deep oversold territory and generates initial warning of some adjustment. Broken cloud base now reverted to strong resistance which should keep the upside protected.

Res: 1.1200, 1.1208, 1.1222, 1.1242

Sup: 1.1181, 1.1170, 1.1160, 1.1134