The Japan Yen surges broadly today on risk aversion as last week’s selloff in NASDAQ is spreading over. At the time of writing, DAX is trading down -0.9% while CAC is down -1.0%. FTSE is down a mere -0.1% as helped by renewed selling in Sterling. While DOW opens nearly flat, NASDAQ is losing another -1% in early trading. Elsewhere, the Pound is under some pressure again as it breaches last week’s low against Euro and Yen. Dollar is also trading softer as despite firm expectation of an FOMC rate hike later in the week.

In US, the political drama surround US President Donald Trump continued. Republicans called Trump to clear the air regarding any recordings on his conversations with former FBI Director James Comey. And they urged Trump to provide them to Congress if he does. Attorney General Jeff Sessions will testify before Senate on Tuesday regarding the firing of Comey. Meanwhile, it’s reported that attorney generals of Maryland and Washington D.C. are filing a lawsuit today against Trump alleging that foreign payments to his businesses violate the Constitution.

Fed is widely expected to raise interest by another 25bps to 1.00-1.25%. Fed fund futures are pricing in 95.8% chance of that. The biggest question in traders mind is whether Fed is still ready to hike another time in September, to make a total of three hikes. There are doubts on whether the US economy could withstand that. And the new economic projections to be released with the rate announcement should shed some lights on policy makers’ mind on it.

A softer Brexit is now possible but negotiation might be delayed

Credit rating agency Moody’s said in a report that the inconclusive election in UK now increases the chance of a "softer" form of Brexit. That would likely include access to the EU single market Also, "while the economic impact of such an outcome would be significantly less severe than the ‘hard’ Brexit pursued so far, it is still far from clear whether these are indeed realistic scenarios." But it also pointed out that the elections result could now "complicate and probably delay Brexit negotiations". And it maintained there are still risks of a "sudden exit".

Talking about delaying Brexit negotiation, UK Brexit Minister David Davis said today that the formal negotiation with EU may not start as scheduled next week on June 19 as scheduled. Davis said that he’s taking with EU on the details. But he pointed out it may not be next Monday "because we’ve also got the Queen’s Speech that week and I will have to speak in that and so on".

Meanwhile, EU’s chief negotiator Michel Barnier insisted on the approach that the divorce bill, citizens rights and border of Ireland should be settled first. Then, discussions on trade agreement could start. An unnamed EU official warned that if UK don’t accept this "phased negotiations", it could take "a year" to draw up a new set of negotiating guidelines for Barnier.

Macron’s LREM to get overwhelm majority in parliament

In France, President Emmanuel Macron’s centrist party looks set to take an overwhelming majority in parliament after the first round of election yesterday. The new La Republique En Marche and its ally MoDem won 32.32% of votes in the first round, well ahead of rival Les Republicain’s alliance at 21.56%. The far-right Front National got 13.2% while Socialist got 9.5%. Based on current estimations, the La Republique En March could get up to 430 seats in the 577 seat parliament after the final round on June 18. And if that happens, it would be a boost for Macron to implement his center right policies including loosing up labor laws and reforming the welfare system.

German Chancellor Angel Merkel expressed her "heartfelt congratulations" to Macron on the "great success" of the party in its first ballot. She hailed that the result was a "strong vote for reforms" that could strengthen the German-French alliance. Both expressed common goal to develop a roadmap to strengthen EU and the Eurozone when they met in Berlin last month. And Macron is clear about his wish to push for reforms in EU, strengthening of Eurozone with a common budget and introduce new executive power in Eurozone with a Euro chamber and a Euro commissioner.

GBP/JPY Mid-Day Outlook

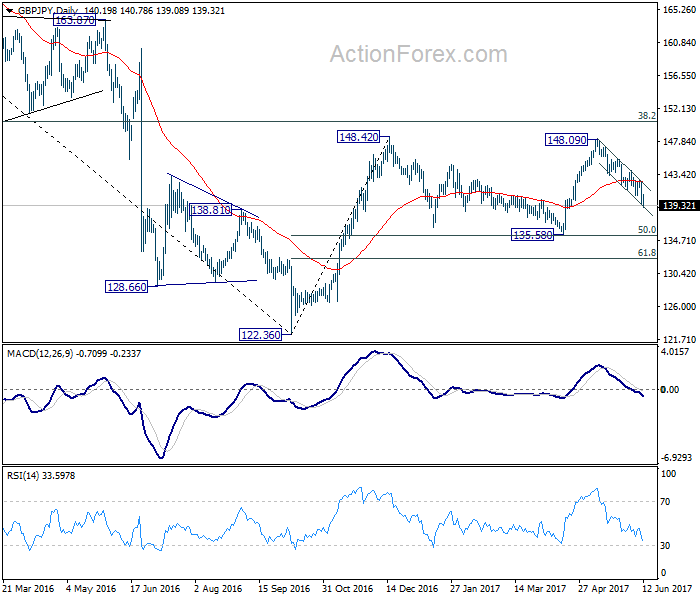

Daily Pivots: (S1) 139.21; (P) 140.86; (R1) 142.22; More….

GBP/JPY’s fall continues today and reaches as low as 139.08 so far. Intraday bias stays on the downside for 135.58 support. As it’s also close to 135.39 fibonacci level, we’d look for bottoming signal around there to bring rebound. However, break of 142.75 resistance is needed to indicate completion of fall from 148.09. Otherwise, near term outlook will say mildly bearish in case of recovery.

In the bigger picture, while the fall from 148.09 is deeper than expected, we’re not bearish in the cross yet. Price action from 148.42 is possibly developing into a sideway pattern with fall from 148.09 as the third leg. Deeper decline could be seen but we’re looking for strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside. Rise from 122.36 is still mildly in favor to resume at a later stage. However, sustained break of 135.58/39 will confirm reversal and target a retest on 122.36 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machine Orders M/M Apr | -3.10% | 0.60% | 1.40% | |

| 23:50 | JPY | Domestic CGPI Y/Y May | 2.10% | 2.20% | 2.10% | |

| 6:00 | JPY | Machine Tool Orders Y/Y May P | 24.40% | 34.70% | ||

| 18:00 | USD | Monthly Budget Statement May | -87.3B | 182.4B |