Key Highlights

- The British Pound declined further below the 1.2570 support against the US Dollar.

- GBP/USD could struggle to recover above 1.2570 and 1.2600 resistance levels.

- The NY Empire State Manufacturing Index declined sharply from 17.8 to -8.6 in June 2019.

- The Euro Zone CPI in May 2019 could increase 0.2% (MoM), less than the last +0.7%.

GBPUSD Technical Analysis

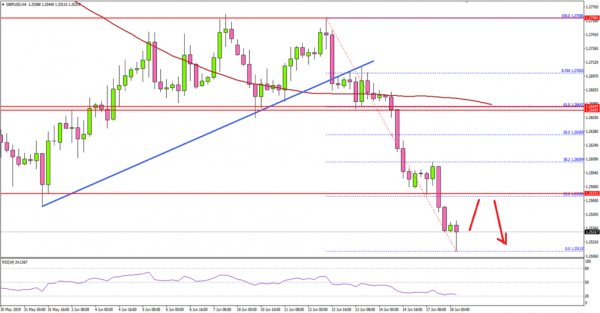

This past week, the British Pound declined sharply from well above 1.2660 against the US Dollar. The GBP/USD pair traded below the 1.2600 support area before it found support near the 1.2500-1.2510 zone.

Looking at the 4-hours chart, the pair failed once again to clear the 1.2760 resistance and started a strong decline. It broke the 1.2650 support, a connecting bullish trend line, and the 100 simple moving average (red, 4-hours).

The pair even broke the 1.2600 support and the 1.2570 pivot zone. A swing low was formed at 1.2511 and the pair recently started a short term upside correction.

It traded above 1.2520 and facing resistance near the 23.6% Fib retracement level of the decline from 1.2758 to 1.2511. The current price action suggests that the pair could struggle to recover above the 1.2570 and 1.2600 levels.

Further to the upside, GBP/USD is likely to face a strong resistance near the 1.2650 level or the 50% Fib retracement level of the decline from 1.2758 to 1.2511.

On the downside, the main supports are near 1.2510 and 1.2500, below which the pair could accelerate its decline towards the 1.2460 or 1.2440 support.

Fundamentally, the NY Empire State Manufacturing Index for June 2019 was released by the Federal Reserve Bank of New York. The market was looking for drop in the index from 17.8 to 10.0.

The actual result was well below the market forecast, as there was a sharp decline in the NY Empire State Manufacturing Index from 17.8 to -8.6.

It sparked short term selling on the greenback, but EUR/USD and GBP/USD failed to remain in a positive zone. Overall, GBP/USD could recover in the short term, but the bulls may struggle near 1.2570 or 1.2600.

Economic Releases to Watch Today

- Euro Zone CPI for May 2019 (YoY) – Forecast +1.2%, versus +1.2% previous.

- Euro Zone CPI for May 2019 (MoM) – Forecast +0.2%, versus +0.7% previous.

- US Housing Starts May 2019 (MoM) – Forecast 1.240M, versus 1.235M previous.

- US Building Permits May 2019 (MoM) – Forecast 1.290M, versus 1.290M previous.