Sterling trades mildly softer against Dollar, Euro and Yen today. But it’s holding above last week’s low so far. After the disastrous election, UK Prime Minister Theresa May announced her new cabinet on Sunday. Stability was clearly seen as her priority as all the most senior ministers stay. The list includes Chancellor of Exchequer Philip Hammond, Foreign Secretary Boris Johnson, Defense Secretary Michael Fallon and Home Secretary Amber Rudd. Also, David Davis kept his job as Brexit Secretary. While there are still calls for May to quit, she seems to have steadied the boat, as least for the moment. And preparing for Brexit negotiation with EU would now be back as one of her top priorities.

The Brexit negotiation with EU is scheduled to formally start on June 19. Ahead of that, May is facing pressure from all front to drop her "hard brexit" approach, including within Conservatives, Labour and her coalition partner DUP. In particular, the Northern Ireland’s DUP is believed to be pushing for a "frictionless border" with the Republic of Ireland, rather than a hard one. And May’s position of "no deal is better than a bad deal" doesn’t have much support from others.

Macron’s LREM to get overwhelm majority in parliament

In France, President Emmanuel Macron’s centrist party looks set to take an overwhelming majority in parliament after the first round of election yesterday. The new La Republique En Marche and its ally MoDem won 32.32% of votes in the first round, well ahead of rival Les Republicain’s alliance at 21.56%. The far-right Front National got 13.2% while Socialist got 9.5%. Based on current estimations, the La Republique En March could get up to 430 seats in the 577 seat parliament after the final round on June 18. And if that happens, it would be a boost for Macron to implement his center right policies including loosing up labor laws and reforming the welfare system.

German Chancellor Angel Merkel expressed her "heartfelt congratulations" to Macron on the "great success" of the party in its first ballot. She hailed that the result was a "strong vote for reforms" that could strengthen the German-French alliance. Both expressed common goal to develop a roadmap to strengthen EU and the Eurozone when they met in Berlin last month. And Macron is clear about his wish to push for reforms in EU, strengthening of Eurozone with a common budget and introduce new executive power in Eurozone with a Euro chamber and a Euro commissioner.

FOMC and BoE to highlight the week, SNB and BoJ also featured

The economic calendar is rather light today. Japan machine orders dropped -3.1% mom in April. Domestic CGPI rose 2.1% yoy in May. Machine tool orders rose 24.4% yoy in May. Looking ahead, meeting of four central banks are the key focuses of the week.

Fed is widely expected to raise interest by another 25bps to 1.00-1.25%. Fed fund futures are pricing in 95.8% chance of that. The biggest question in traders mind is whether Fed is still ready to hike another time in September, to make a total of three hikes. There are doubts on whether the US economy could withstand that. And the new economic projections to be released with the rate announcement should shed some lights on policy makers’ mind on it. Also from US, PPI, CPI, retail sales, regional Fed surveys, industrial production and some housing data will be released.

BoE monetary policy decision will be another focus. Main policy rate will be held at 0.25% while the asset purchase target kept at GBP 435b. This is the general expectation. The voting will be the main focus. In particular, markets would like to see if Kristin Forbes would continue to vote for a rate hike. And head of the meeting, UK will also release CPI, employment and retail sales. Headline CPI is expected to be unchanged at 2.7% yoy in May and a surprise there might change Forbes’ mind. SNB and BoJ will also meet this week and both are expected to stand pat. These two are most likely non-events.

Here are some highlights for the week:

- Tuesday: Australia NAB business confidence; UK CPI and PPI; German ZEW; US PPI

- Wednesday: China industrial production, retail sales, fixed asset investment; UK employment; Eurozone employment, industrial production; US CPI, retail sales, FOMC

- Thursday: New Zealand GDP; Australia employment; SNB rated decision, CPI; UK retail sales, BoE; Eurozone trade balance; Canada manufacturing sales; US jobless claims, Empire State manufacturing index, Philly Fed survey, import price, industrial production, NAHB housing index.

- Friday: BoJ; Eurozone CPI final; US housing starts and building permits, U of Michigan sentiment

EUR/GBP Daily Outlook

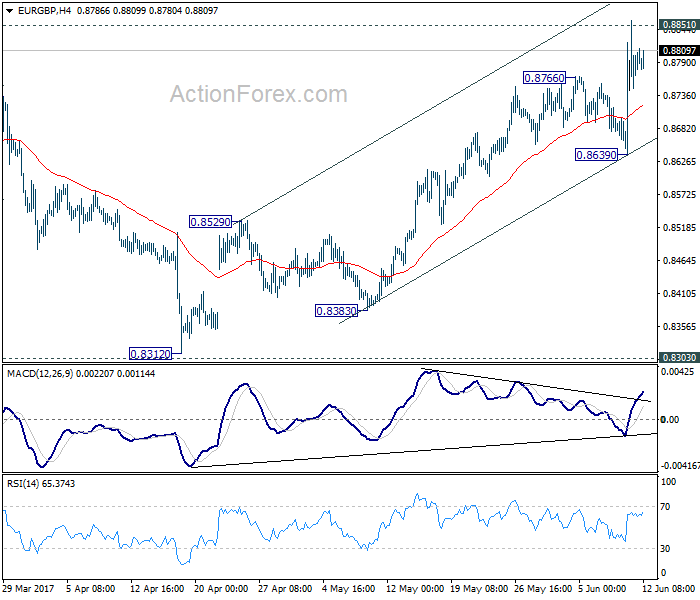

Daily Pivots: (S1) 0.8670; (P) 0.8764; (R1) 0.8879; More…

Intraday bias in EUR/GBP stays on the upside for the moment with focus on 0.8851 resistance. Decisive break there will extend the rally from 0.8312 to retest 0.9304 high. At this point, there is no clear sign of larger up trend resumption yet. Hence, we’ll be cautious on topping around 0.9304. On the downside, however, break of 0.8639 support will now indicate near term topping and bring deeper pull back to 55 day EMA (now at 0.8601) and below.

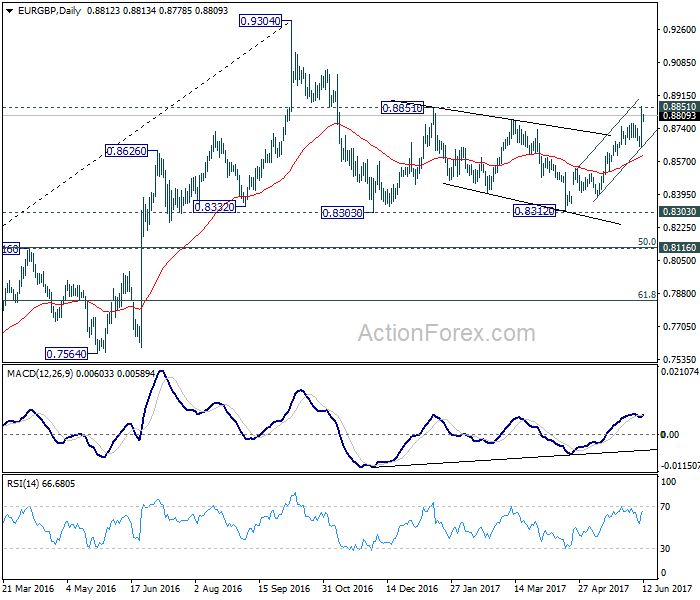

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. The leg from 0.9304 should have completed after testing 0.8332 structural support. But it’s too early to say that larger rise from 0.6935 is resuming. Rejection from 0.9304 will extend the consolidation with another falling leg. Meanwhile, firm break of 0.9304 will target 0.9799 (2008 high). In case of another decline, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside and bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machine Orders M/M Apr | -3.10% | 0.60% | 1.40% | |

| 23:50 | JPY | Domestic CGPI Y/Y May | 2.10% | 2.20% | 2.10% | |

| 6:00 | JPY | Machine Tool Orders Y/Y May P | 24.40% | 34.70% | ||

| 18:00 | USD | Monthly Budget Statement May | -87.3B | 182.4B |