The price of crude oil declined sharply after the EIA released weekly inventory data. The numbers showed that the inventories rose by 6.7 million barrels. This was much higher than the drawdown of more than 849K that investors were expecting. It was also higher than the 3.5 million released by the American Petroleum Institute (API). The current declines put crude prices in a bear market. This could force OPEC to make changes when the leaders meet later this month.

The euro weakened ahead of the ECB decision expected later today. The bank is expected to leave interest rates, the marginal lending facility and the deposit facility rate unchanged at 0%, 0.25%, and -0.40%. Traders will want to listen to the bank’s response to the ongoing trade conflict between the US, China, Mexico and the European Union. Eurostat will also release the final reading of the first quarter GDP. The economic growth is expected to remain unchanged at 1.2%.

The Australian dollar declined after the statistics office released trade data. In April, the exports increased by 3%. The trade surplus declined to A$4.871 billion, which was lower than the expected A$5.05 billion. In March, the surplus was A$4.88 billion. Exports of non-monetary gold rose by A$272 million while rural goods declined by 2%. This came a day after the country released the GDP numbers, which showed that the economy expanded by 1.8% in Q1.

EUR/USD

The EUR/USD pair declined sharply in overnight trading ahead of the ECB decision. The pair fell from a high of 1.1307 to a low of 1.1218. On the hourly chart below, the price is along the 61.8% Fibonacci Retracement level. It is also slightly above the 25-day and 50-day moving averages. The Parabolic SAR is also on the right side of the price. The RSI remains slightly above the oversold level of 30. The pair will likely move in either direction after the ECB decision.

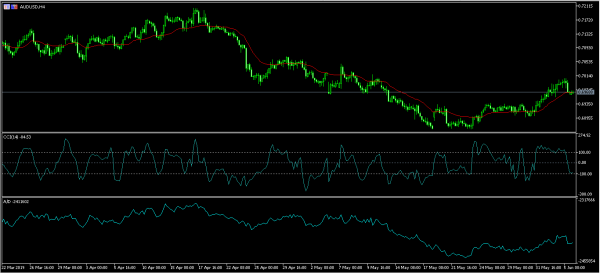

AUD/USD

After a few days of gains, the AUD/USD pair declined after weak trade data. The pair is now trading at 0.6968. This price is at the same level as the variable index dynamic average. The commodity channel index has declined to the oversold level while the accumulation/distribution indicator has eased slightly. There is a likelihood that the pair will resume the upward trend today.

XTI/USD

The XTI/USD pair declined sharply to a low of 50.65. This is a 24% decline from the YTD high of 66.53. This means that the price is in a bear market. On the four-hour chart, the price is below all the moving averages and is along the lower line of the Bollinger Bands. The RSI and the Relative Vigor Index remains in the oversold level. While the downward momentum could continue, there is a possibility that the pair could see some gains today.