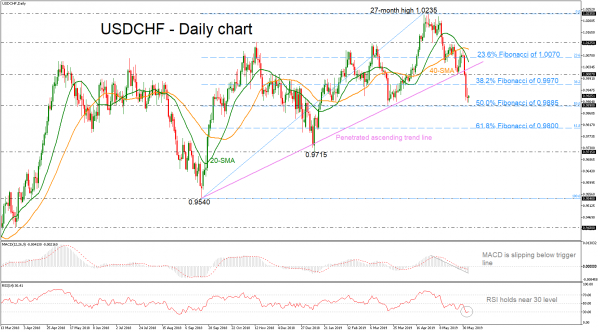

USDCHF is extending its bearish rally over the last few days, breaking the long-term rising trend line to the downside. The pair tumbled to a new ten-week low around the 0.9900 handle and technical indicators are still suggesting losses in the market. The MACD is stretching its bearish momentum below the trigger and zero lines, while the RSI is flattening near the 30 level.

The pair entered into bearish mode, edging towards the 50.0% Fibonacci retracement level of the upward wave of 0.9540 to 1.0235, around 0.9885. More downside pressure could drive USDCHF until the 61.8% Fibonacci mark of 0.9800.

If the pair gains some positive momentum, immediate resistance could be faced near the 38.2% Fibonacci of 0.9970 ahead of the 1.0070 barrier. Even higher, the pair could flirt with the 20-day moving average currently at 1.0052.

Concluding, investors should turn eyes on negative orders after the pair penetrated the ascending trend line, unless there is a bounce off the 50.0% Fibonacci (0.9885) or at the ten-week low of 0.9900.