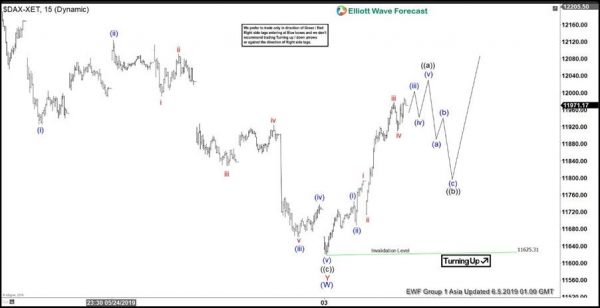

Elliott wave view in DAX calls the pullback to 11625.31 as ending wave (W). This move lower ended the decline from May 3 high. The Index thus is within wave (X) rally to correct the cycle from May 3 high (12435.67) before the it resumes lower again. On the chart below, we can see the rally from June 3 low (11625.31) is unfolding as an impulse Elliott Wave structure. Up from 11625.31, Wave (i) ended at 11744.93, wave (ii) ended at 11689.51, and wave (iii) remains in progress. Wave (iii) subdivides as another impulse Elliott Wave structure in lesser degree.

Expect the Index to see 1 more high before ending wave ((a)) as 5 waves. It should then pullback in wave ((b)) to correct the cycle from June 3 low in 3, 7, or 11 swing before turning higher. As the first leg of the rally from June 3 low is in 5 waves, there’s a good chance that the rally can extend at least another leg higher in wave ((c)) as far as pivot at 11625.31 low remains intact during the pullback. We don’t like selling the Index.

DAX 1 Hour Elliott Wave Chart