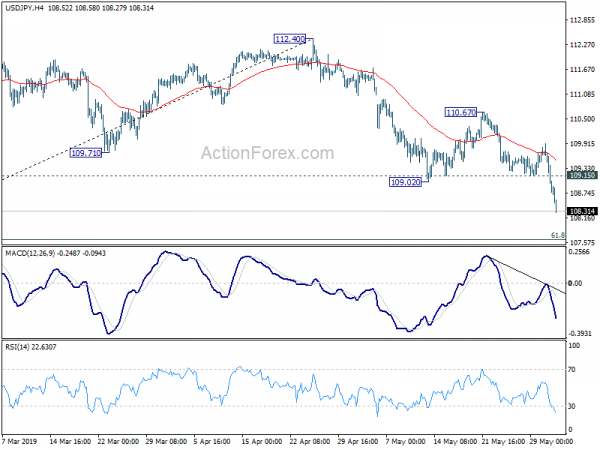

USD/JPY’s decline from 112.40 resumed last week by dropping through 109.02 support and hit as low as 108.27. Initial bias stays on the downside this week for 61.8% retracement of 104.69 to 112.40 at 107.63. Sustained break there will pave the way back to 104.62/9 key support zone. On the upside, break of 109.15 support turned resistance is needed to be the first sign of short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

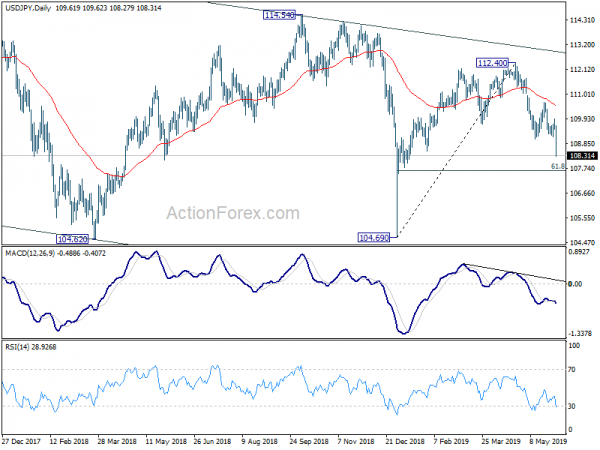

In the bigger picture, decline from 118.65 (Dec 2016) is still in progress, with the pair staying indicate long term falling channel. Break of 104.62 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51. For now, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound.

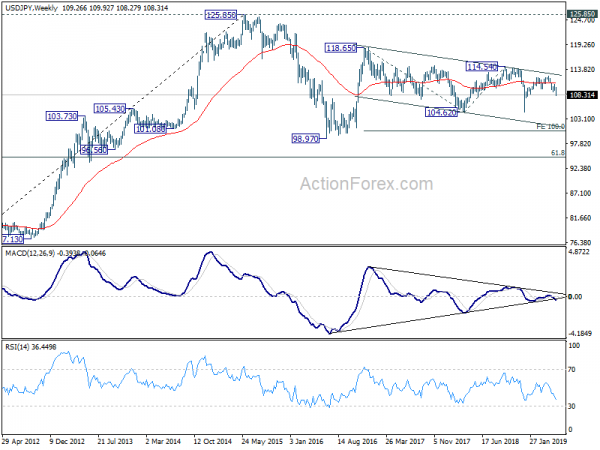

In the long term picture, the rise from 75.56 (2011 low) long term bottom to 125.85 (2015 high) is viewed as an impulsive move, no change in this view. Price actions from 125.85 are seen as a corrective move which could still extend. In case of deeper fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77. Up trend from 75.56 is expected to resume at a later stage for above 135.20/147.68 resistance zone.