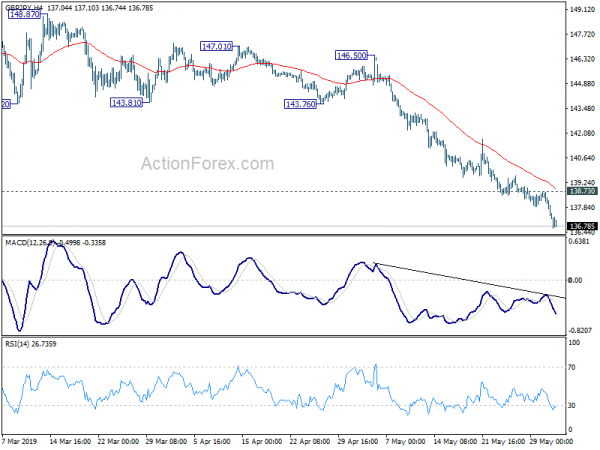

GBP/JPY’s fall reaccelerated to as low as 136.63 last week and initial bias stays on the downside this week. Now that 61.8% retracement of 131.51 to 148.87 at 138.14 is firmly taken out, next target will be 131.51 low. On the upside, break of 138.73 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another fall.

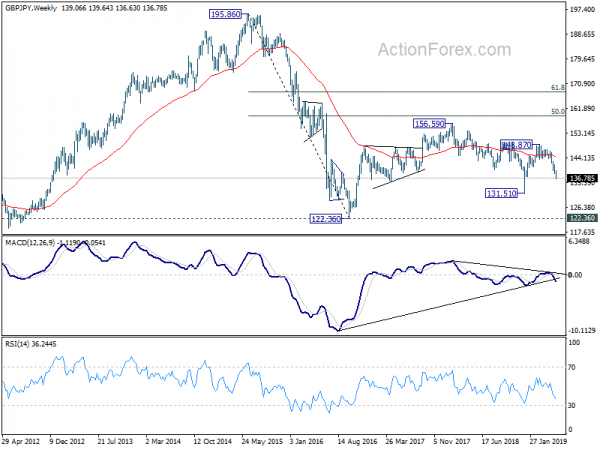

In the bigger picture, current development suggests that GBP/JPY medium term fall from 156.59 (2018 high) is still in progress. Break of 131.51 will target 122.36 (2016 low). Structure of such decline is corrective looking so far, arguing that it’s just the second leg of consolidation from 122.36. Thus, we’d expect strong support from 122.36 to contain downside to bring reversal.

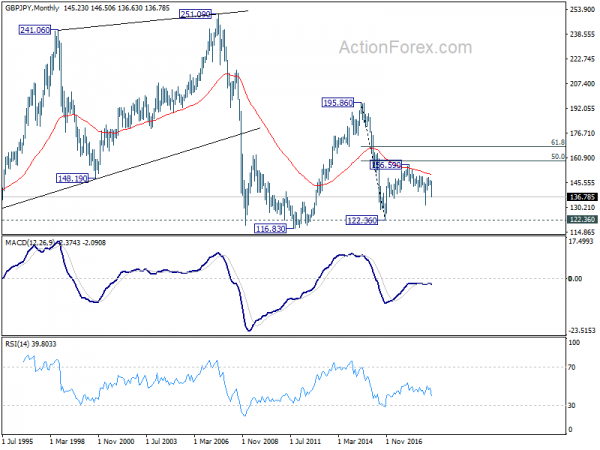

In the longer term picture, firstly, GBP/JPY’s is kept well below 55 week EMA, keeping outlook bearish. But we’re treating price actions from 122.36 as a corrective pattern. Hence, we’d expect range trading to continue longer. In case of an extension, strong resistance is likely to be seen at 50% retracement of 195.86 (2015 high) to 122.36 at 159.11 to limit upside. However, break of 122.26 will put 116.83 (2011 low) back into focus.