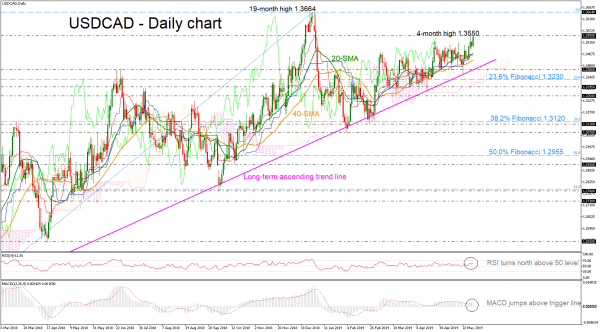

USDCAD is trading not too far from Wednesday’s new four-month high of 1.3550, following the rebound on the long-term ascending trend line in the daily timeframe.

The momentum indicators suggest that there is still some advance for the pair. The RSI indicator is sloping upwards in the positive territory, while the MACD surpassed the trigger line and is rising above the zero line. Price action at the moment is above the Ichimoku cloud so the risks are to the upside.

Should the pair make another rally higher and jumps above the four-month high, it would open the way for the 19-month high of 1.3664 registered on December 31. Steeper increases could drive the bulls towards the 1.3790 resistance, taken from the peaks on April 2017.

If the upward momentum fails to hold and prices return lower, the 20-day simple moving average (SMA) currently at 1.3460 is the nearest support for the bears. A leg below this hurdle could send the pair to a more important support of the 40-SMA and upper surface of the Ichimoku cloud near 1.3430. If breached, the focus would shift to the 1.3380 support and the uptrend line.

In all timeframes, USDCAD maintains a bullish profile and traders could turn their attention towards the 19-month high (1.3664) if there is daily close above the four-month high (1.3550).