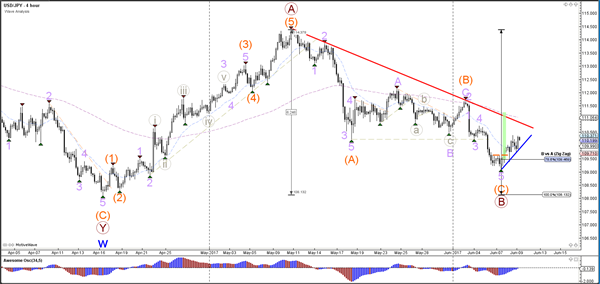

Currency pair GBP/USD

The UK general parliamentary election took place yesterday on Thursday 8th of June 2017 and the election results indicate that the Conservative Party has lost its parliamentary majority. The Prime Minister Theresa May fails to increase her majority, as originally intended when calling for new elections in April, but also falls short of the 326 seats needed to keep its current majority.

The GBP/USD reacted bearish to the election results as the likelihood of a hung parliament (no party having a majority) increased during the election night. Price broke support (dotted green) and managed to reach the bottom of the consolidation (purple box) and the Fibs of wave 4 (orange). The other wave scenario is outlined via the wave 123 (red) structure, which becomes more likely if price manages to break below the support trend line (blue) and reach the 161.8% target of wave 3.

The GBP/USD bearish price action was strong as the UK election results were announced during the night. At this moment it is unclear whether the bearish momentum is part of a larger correction (wave 4 orange) or a new downtrend (wave 3 red). A break below 1.27 would favour a new downtrend.

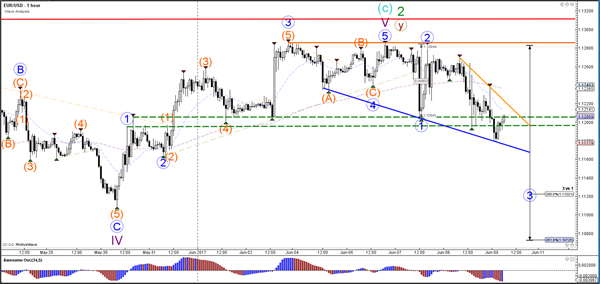

Currency pair EUR/USD

The EUR/USD was unable to break the 100% Fib resistance level at 1.13 and slightly pushed below the support zone at 1.12.The failure to break the 1.13 invalidation level keeps the current wave structure intact.

The EUR/USD will also need to break below support (blue) before a wave 3 (blue) indeed becomes a more likely scenario.

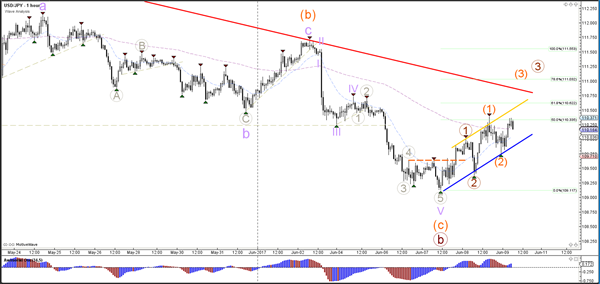

Currency pair USD/JPY

The USD/JPY has bounced at the 78.6% Fibonacci level of wave B (brown) but it remains to be seen on lower time frames if this is a reversal upwards or a correction for more bearish price action.

The USD/JPY is in a bullish channel (blue/yellow), which has reached the 50% Fibonacci level. A bullish break above the 50% Fibonacci level indicates that the wave B (brown) has most likely been completed at the low.