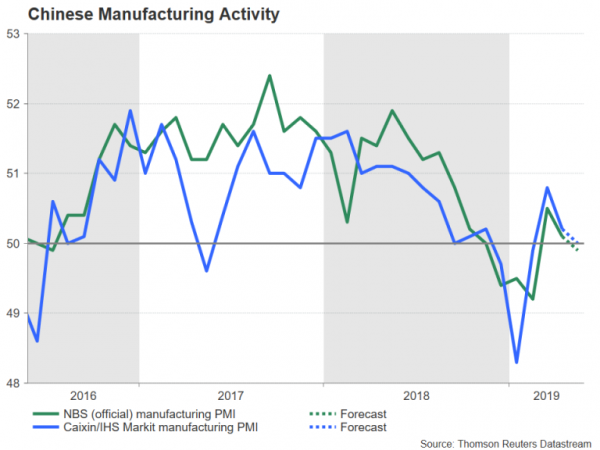

Manufacturing PMIs out of China in the coming days will provide investors with the first indication of how the world’s second largest economy performed in May. The official manufacturing gauge is due first on Friday at 01:00 GMT, followed by the Caixin/Markit manufacturing PMI on Monday at 01:45 GMT. With no end in sight to the year-long trade dispute between the US and China, manufacturing activity is at risk of contracting again from the mounting uncertainty, while the yuan is in danger of breaching key support at the 6.92 per dollar level.

Growth rebound faltering?

It wasn’t that long ago that things were looking up for the Chinese economy as a trade deal was within reach and exports were rebounding. But it’s beginning to appear like the growth revival is going to be a slow process, with further monetary and fiscal stimulus likely required to support the economy. Potentially making the road to recovery significantly more difficult is the trade dispute becoming a long-drawn-out conflict and worse, evolving into a technology ‘cold war’.

Manufacturing activity could contract in May

With little respite therefore for Chinese businesses, manufacturing activity is expected to ease in May. The country’s official manufacturing PMI is forecast to slip just below 50 into contraction territory, declining from 50.1 to 49.9 in May. The Caixin/Markit PMI is also anticipated to head lower, falling from 50.2 to 50.0.

A weak set of PMIs would probably increase speculation that authorities would step in and announce more stimulus measures to help the struggling economy. Data out earlier this week showed profits by industrial companies were down in April on an annual basis for the third month in a row. The recent US ban on Huawei has underscored the growing challenges facing Chinese firms and could be the start of further restrictions being imposed by the Trump administration on China’s corporate giants.

Yuan getting dangerously close to 7.00 per dollar level

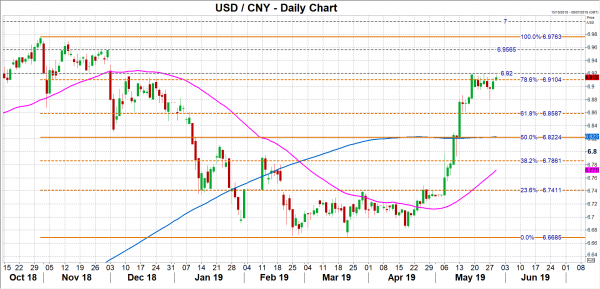

Negative headlines from the upcoming data risk driving the yuan to fresh yearly lows against the US dollar, which would only aggravate relations with the US and draw accusations of currency manipulation. Dollar/yuan has been hovering just below the 6.92 level for the past 12 days in onshore trading, possibly signalling state intervention to prevent steeper advances for the dollar.

A break above 6.92 would bring into range the 6.9565 region, which was a strong resistance area back in November. Higher up, the next target for yuan bears would be October’s 10-year high of 6.9763 before attention turns to the psychologically important 7.00 level.