Oil bounces along the seafloor bottom overnight as precious metals continue their bullish unwind from earlier in the week, ignoring an emotional U.K. election.

Crude Oil

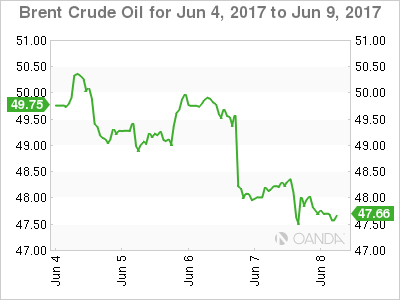

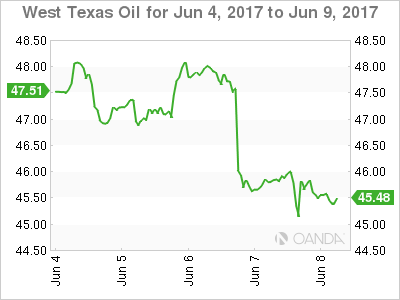

Both Brent and WTI closed almost unchanged overnight despite both attempting a failed dead cat bounce in the New York session leaving the crude contracts down some 5.0% for the week. Following the king hit from the Crude Inventories number Thursday morning (Singapore time), both contracts have a suspiciously consolidative look about them before more downside as we run into the week’s end.

The Baker Hughes Rig Count this evening is unlikely to provide much respite either, and oil will probably have to rely on a weaker U.S. dollar or some headline-driven volatility to pick itself up off the floor.

Brent spot trades at 47.45 in early Asia with resistance at 48.50 and then 50.00. Support is very near at 47.40 with the next level below this the May liquidation low at 46.30.

WTI spot trades at 45.30 with resistance at 46.50 and then 48.20. Support again is very near at 45.00 with a break potentially targeting its May low of 43.50.

Precious Metals

Gold clung on to its uptrend overnight by the skin of its teeth, just managing to hold recent trend line support, this morning at 1274.30. A flat stock market in the U.S. and no new bombshells from ex-FBI Director Comey in Congress seems to have unwound some of the safe haven premia from gold in the last 24 hours.

Looking at gold’s price action, the gold price may well have had a significant amount of uncertainty built into it over the week which was given a further boost by a weaker U.S. Dollar initially. Traders may also have taken fright by the failure of gold to breach its April high of 1296.00 this week leaving a technically significant double top now at this level on the charts.

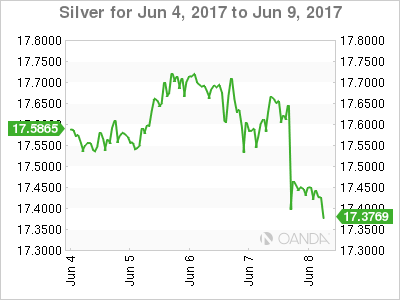

Ahead of the weekend, it would not be surprising to see Asia hedge some weekend risk and for buying to emerge in the session. However, gold may take its cue from Silver as it did yesterday, with the later breaking critical support at 17.5000 overnight which also took out it’s 100 and 200-day moving averages. If silver continues to drop to its next support near 17.2000, this may be the straw that breaks gold’s back.

This morning Gold trades at 1279.50 with resistance at 1289.00 followed by 1296.00 and then 1300.00, implying the yellow metal has a lot of wood to chop from a technical standpoint. Support is nearby at the 1274.30 level as mentioned above followed by 1270.00 with a break of this level implying a possible move to 1259.00.