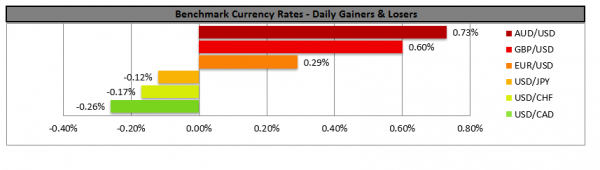

The EUR maintained its strength early Monday morning as the results of the EU Parliament elections were released. Despite center right and center left parties losing power, the greens and liberals strengthened, keeping the pro-EU option strong. It should be noted that in Italy and France extreme right parties gained on votes and could provide some uncertainty in Italy and France. Analysts were quick to note that pro-EU parties still have a majority and expect market focus to return to the US-Sino trade wars. Given the removal of the EU election uncertainty, we could see the EUR getting some support, yet the EUR could be data driven. EUR/UDS rose on Friday and during today’s Asian session, opened with a positive gap, aiming for the 1.1220 (R1) resistance line. We could see the pair maintain a sideways movement today, yet some bullish tendencies could be observed in the aftermath of the EU elections. Should the pair find fresh buying orders along its path, we could see it breaking the 1.1220 (R1) resistance line, aiming for higher grounds. Should it come under the market’s selling interest we could see it aiming if not breaking the 1.1175 (S1) support line.

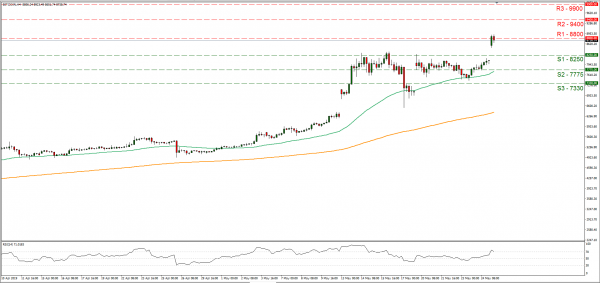

Bitcoin rises over 8,500 in a spectacular move

Bitcoin rose over 8,500 over the weekend, having an impressing push upwards as demand rose substantially. The rise of the market-cap encourages crypto bulls for further gains as it is at its highest for the past year. Analysts are citing a number of recent headlines which mention that mainstream firms are interested in the cryptocurrency, implying that a wider adoption of Bitcoin is in the works. Should the positive headlines about the crypto-market continue to reel in, we could see Bitcoin rising even further. Bitcoin prices surged during the weekend, breaking the 8250 (S1) resistance (now turned to support) line and testing the 8800 (R1) resistance level. Should the positive headlines for Bitcoin continue to reel in, we could see the crypto rising further. Please note that the RSI indicator in the 4 hour chart has surpassed the reading of 70, implying a rather overcrowded position. If the bulls maintain control over Bitcoin’s direction, we could see it breaking the 8800 (R1) resistance line and aim for the 9400 (R2) resistance level. Should the bears take over we could see it aiming if not breaking the 8250 (S1) support line.

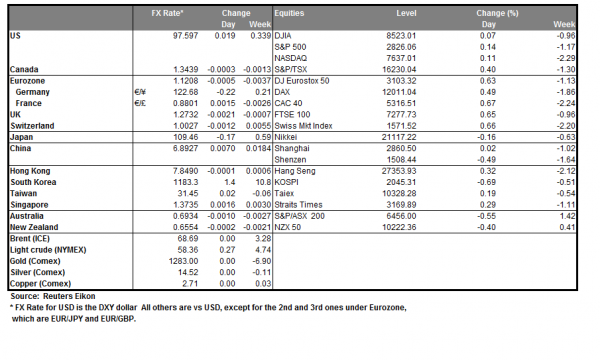

Other economic highlights, today and early tomorrow

No major releases are expected today and tomorrow during the Asian session. Also please note that the UK and the US will be on holiday, so some thin trading could be present.

As for the rest of the week

On Tuesday, we get from Germany the Gfk Consumer Sentiment for June, from Eurozone the business and industrial climate for May and from the US the Consumer Confidence for May. On Wednesday, we get for France the preliminary CPI (EU Norm.) rate for May, Germany’s employment data for May and from Canada BoC’s interest rate decision. On Thursday, we get from the US the 2nd estimate of the GDP growth rate for Q1. On Friday, we get from Japan the unemployment rate for April and the preliminary industrial production rate for April, from China the NBS Mfg PMI for May, from Germany the preliminary HICP rate for May, the retail sales growth rate for April, from the US the Core PCE price growth rate for April, the consumption rate for April, the final Michigan consumer sentiment for May and from Canada the GDP growth rates for Q1.

Support: 8800 (S1), 9400 (S2), 9900 (S3)

Resistance: 8250 (R1), 7775 (R2), 7330 (R3)

Support: 1.1175 (S1), 1.1125 (S2), 1.1075 (S3)

Resistance: 1.1300 (R1), 1.1260 (R2), 1.1220 (R3)