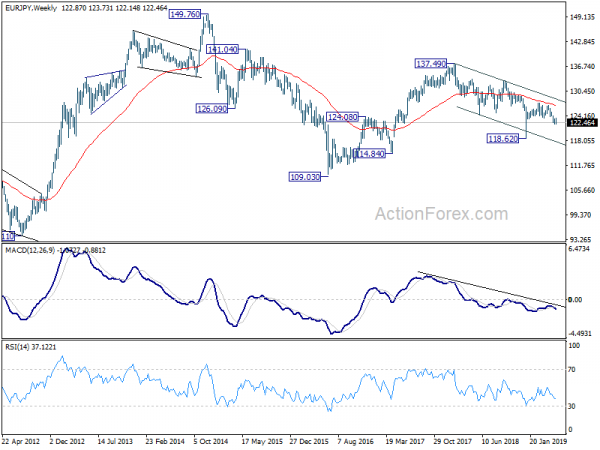

EUR/JPY stayed in consolidation from 122.08 last week and outlook is unchanged. Initial bias remains neutral this week and some more sideway trading could be seen first. In case of another recovery, upside should be limited by 124.09 support turned resistance to bring fall resumption eventually. On the downside, firm break of 122.08 will resume the fall from 127.50 and target 118.62 low next. Nevertheless, firm break of 124.09 will at least bring stronger rebound back to 125.23 resistance and above.

In the bigger picture, current development argues that rebound from 118.62 is merely a correction and has completed at 127.50. EUR/JPY is staying in long term falling channel from 137.49 (2018 high). Decisive break of 118.62 will confirm resumption of this medium term fall and target 109.20 low. For now, this will be the favored case as long as 125.23 resistance holds.

In the long term picture, EUR/JPY is staying in long term sideway pattern, established since 2000. Fall from 137.49 is seen as a falling leg inside the pattern. Break of 118.62 will extend this falling leg through 109.03 low. On the upside, break of 133.12 resistance bring retest of 149.76 (2014 high).