Euro dips mildly after ECB left monetary policies unchanged as widely expected. The central bank moved a tiny step by closing the door for further rate cut. But it leaves the door open for extending the asset purchases. Meanwhile, inflation forecasts were revised down as media reported earlier in the week. But that was offset by the upward revision in growth forecasts. Markets will now look into former FBI Director James Comey’s hearing in Senate Intelligence Committee. At the same time, voters in UK are going to vote for their government. Exit polls are expected to be published at around 2200 GMT. By that time, hopefully, we will have a clearer picture on the results of the election, a landslide Conservative victory, a hung parliament, or a surprised Labour win.

ECB: Risks "broadly balanced"

ECB kept key interest rate at 0% and deposit rate at -0.4% today. Asset purchase is held at EUR 60b per month, run through December this year. President Mario Draghi risks to outlook are now "broadly balanced" as the Eurozone is enjoying "stronger momentum" as a "somewhat faster pace than previously expected. Nonetheless, he maintained that substantial degree of monetary accommodation is still needed.

Door for further rate cut closed

ECB closed the door for further rate cut as it said in the statement that "the Governing Council expects the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases." Previously ECB said that "… at present or lower levels… ". However, ECB maintained the open door for extending the asset purchase program as it noted that "net asset purchases, at the new monthly pace of €60 billion, are intended to run until the end of December 2017, or beyond, if necessary."

Inflation projection revised down, growth up

The latest staff economic projections showed downward revision to inflation forecasts. ECB now projections CPI to be at 1.5% in 2017, 1.3% in 2018 and 1.6% in 2019. That compared to prior forecasts of 1.7% , 1.6% and 1.7% respectively. Draghi said that was mainly because of lower oil prices. On the other hand, growth projections are revised higher. ECB now forecasts GDP growth to be at 1.9% in 2017, 1.8% in 2018 and 1.7% in 2019. That compares to prior 1.8%, 1.7% and 1.7% respectively.

Swiss CPI beat expectation

Swiss CPI rose 0.2% mom and 0.5% yoy in May, above expectation of 0.0% mom, 0.3% yoy. Swiss unemployment rate dropped to 3.2% in May. Business lobby Economiesuisse said that it expected the Swiss economy to grow 1.7% in 2017 and then 2.0% in 2018. That compared to the government’s forecast of 1.7% in 2017 and 1.9% in 2018. The group’s chief economist Rudolf Minsch noted that there is "still some way to overcoming the franc shock", referring to the even in January 2015 that SNB suddenly removed the Franc cap versus Euro. But he noted that ‘the largest part of it is now done". Meanwhile, Minsch saw "broad-based" improvement this year as comparing with last year.

US jobless claims stayed low

Released from US, initial jobless claims dropped -10k to 245k in the week ended June 3, slightly above expectation of 241k. It’s now stayed below 300k handle for the 118 straight weeks, longest run since early 1970s. Four week moving average rose 2.25k to 242k. Continuing claims dropped 2k to 1.92m. It stayed below 2m handle for eight straight week, first time since 1973/74. Canada housing starts dropped to 194.7k in May, new housing price index rose 0.8% mom in April.

Elsewhere

German industrial production rose 0.8% mom in April. Eurozone GDP was finalized at 0.6% qoq in Q1, revised up from 0.5% qoq. UK RICS house price balance dropped to 17 in May. Japan Q1 GDP growth was finalized at 0.3% qoq, below expectation of 0.6% qoq. GDP deflator dropped -0.8% yoy. Japan current account surplus widened to JPY 1.81T in April. China trade surplus widened to USD 40.8b, CNY 282b in May. Australia trade surplus narrowed sharply to AUD 0.56b in April.

EUR/USD Mid-Day Outlook

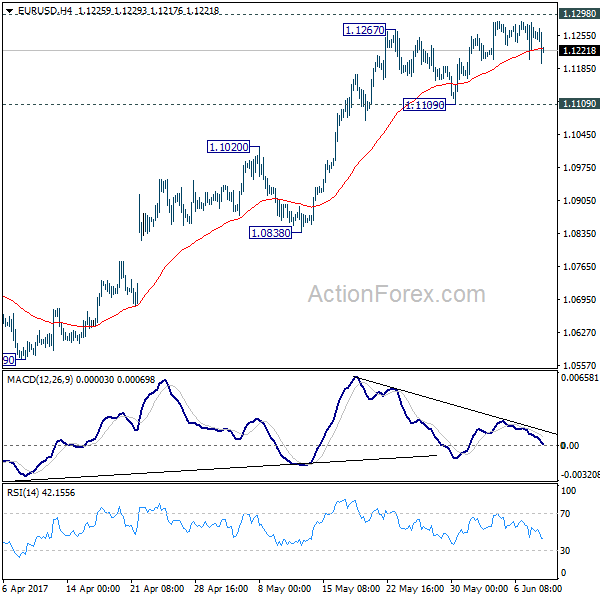

Daily Pivots: (S1) 1.1212; (P) 1.1247 (R1) 1.1291; More….

EUR/USD dips mildly against but it’s still bounded in range above 1.1109 support. Intraday bias remains neutral with focus on 1.1298 key resistance level. Decisive break of 1.1298 will carry larger bullish implication and target 1.1615 resistance next. However, break of 1.1109 will indicate short term topping and rejection from 1.1298. In that case, intraday bias will be turned back to the downside for 1.0838 support first.

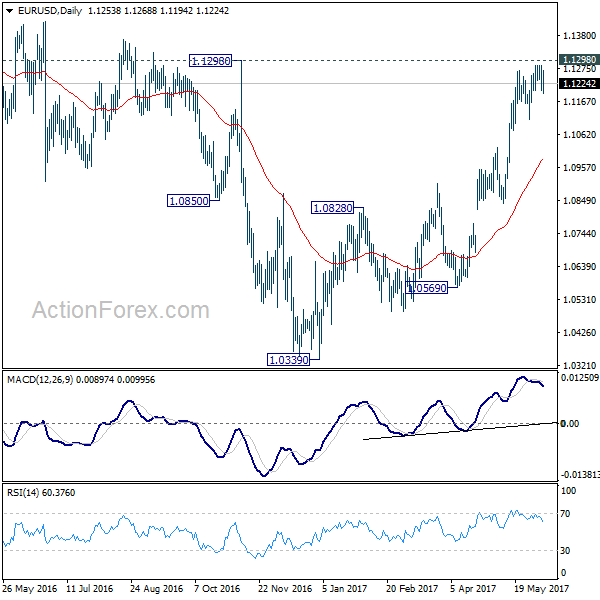

In the bigger picture, the case for medium term reversal continues to build up with EUR/USD staying far above 55 week EMA (now at 1.0888). Also, bullish convergence condition is seen in weekly MACD. Focus will now be on 1.1298 key resistance. Rejection from there will maintain medium term bearishness and would extend the whole down trend from 1.6039 (2008 high). However, firm break of 1.1298 will indicate reversal. In such case, further rally would be seen back to 1.2042 support turned resistance next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS House Price Balance May | 17.00% | 20.00% | 22.00% | |

| 23:50 | JPY | GDP Q/Q Q1 F | 0.30% | 0.60% | 0.50% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 F | -0.80% | -0.80% | -0.80% | |

| 23:50 | JPY | Current Account (JPY) Apr | 1.81T | 1.62T | 1.73T | |

| 01:30 | AUD | Trade Balance (AUD) Apr | 0.56B | 1.99B | 3.11B | 3.17B |

| 02:30 | CNY | Trade Balance (USD) May | 40.8B | 47.5B | 38.1B | |

| 02:30 | CNY | Trade Balance (CNY) May | 282B | 336B | 262B | |

| 05:00 | JPY | Eco Watchers Survey Current May | 48.6 | 48.5 | 48.1 | |

| 05:45 | CHF | Unemployment Rate May | 3.20% | 3.30% | 3.30% | |

| 06:00 | EUR | German Industrial Production M/M Apr | 0.80% | 0.50% | -0.40% | -0.10% |

| 07:15 | CHF | CPI M/M May | 0.20% | 0.00% | 0.20% | |

| 07:15 | CHF | CPI Y/Y May | 0.50% | 0.30% | 0.40% | |

| 09:00 | EUR | Eurozone GDP Q/Q Q1 F | 0.60% | 0.50% | 0.50% | |

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | 0.00% | |

| 12:15 | CAD | Housing Starts May | 194.7K | 205K | 213K | 213.5K |

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | CAD | New Housing Price Index M/M Apr | 0.80% | 0.30% | 0.20% | |

| 12:30 | USD | Initial Jobless Claims (JUN 03) | 245K | 241K | 248K | 255K |

| 14:30 | USD | Natural Gas Storage | 98B | 81B |