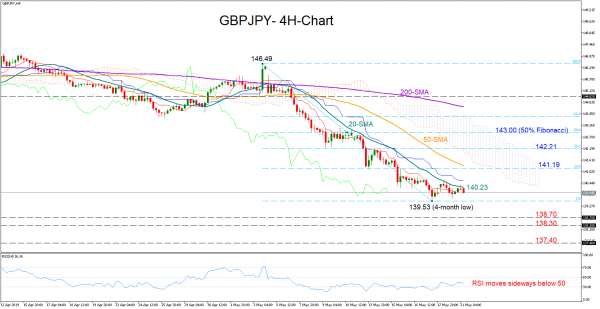

GBPJPY continued with losses for the second week in a row, dropping to a four-month low of 139.53 last Friday and near a key support area before turning neutral.

The RSI in the four-hour chart continues to lack direction while remaining in bearish area and the red Tenkan-sen keeps flattening below the blue Kijun-sen line, reducing chances for a meaningful recovery in the short-term.

However, should the price close comfortably above the 20-period moving average (SMA) (140.23), which has not been broken over the past two-weeks, traders could push the pair up to 141.19; the 23.6% Fibonacci of the downleg from 146.49 to 139.53 and a former key barrier. Other Fibonacci levels that acted as support and resistance in the recent past are 142.21 and 143 and these levels could now attract significant interest in case of an upswing.

In the negative scenario where the 20-period SMA continues to restrict upside moves, the market could retest the bottom of 139.53. If this level is overcome, the decline may next pause somewhere between 138.30-1.38.70, while even lower, investors could shift attention to the 137.40 number.

In brief, GBPJPY is in neutral mode in the very short-term time-frame and bearish in the bigger picture.