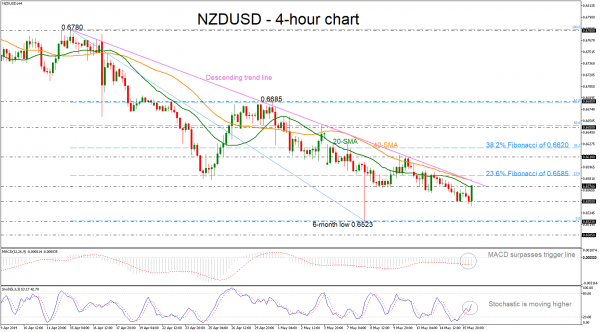

NZDUSD declined earlier on Thursday, hitting a one-week low of 0.6544 but the price recovered most of its lost ground immediately. What remains to be seen is if the bulls have enough fuel to exit the steep descending trend line drawn from the April peak. The stochastic and the MACD are in favor of this scenario, suggesting more upside pressure as both are turning higher.

The downtrend line around 0.6580 will attract full attention on the way up. Should the price break the line to the upside, the rally may get further legs, with the spotlight turning next to the 23.6% Fibonacci retracement level of the downleg from 0.6780 to 0.6523, near 0.6585. A decisive close above the latter, could be considered a big achievement, opening the door for the 0.6610 resistance.

In the alternative scenario, the pair may retry to violate the 0.6550 support to drive the price back down to the six-month low of 0.6523. If the attempt proves successful, the next target would be lower around 0.6505, registered on October 31.

To sum up, NZDUSD has been in a downside movement in the near-term, however, in the very short-term, the market seems to be ready to penetrate the diagonal line to the upside and therefore shift the bearish view to neutral.