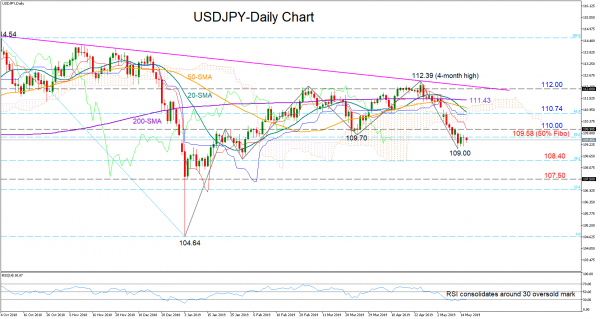

USDJPY paused its sell-off around the 109 round level earlier this week as the RSI signaled that bearish pressures were exhausted. The indicator is currently moving sideways along its 30 oversold mark, hinting that a consolidation phase may follow before the price potentially rebounds.

Sellers could wait for the price to rise well above the 109.70-110 area and hence jump back above the previous low of the January uptrend to re-enter the market. Slightly higher, the 61.8% Fibonacci of 110.74 of the downleg from 114.54 to 104.64 could provide some resistance ahead of the 200-day simple moving average (SMA) currently near 111.43, while the main target remains the descending line (112) drawn from the 114.54 peak.

Should the market fail to hold above the 109 mark, the bears could retake control with scope to beat the 38.2% Fibonacci of 108.40. Moving lower, the 107.50 support may prove even tougher to break.

In the medium-term picture, the outlook has turned neutral after the fall below 109.70. A new bullish phase could emerge above the 112.39 level, while a drop below 107.50 would switch the outlook to bearish. In the meantime, this broad range is expected to hold.