April Labour Force Survey: Total employment: 28.4k from 27.7k (revised from 25.7k). Unemployment rate: 5.2% from 5.1% (revised 5.0%). Participation rate: 65.8% from 65.7% (unrevised 65.7%).

April was a mixed update from the Labour Force Survey. Gains in total employment remain on a robust trend with unemployment rising due to surge in participation. As we noted in our preview while the business surveys suggest that winter is coming for the Australian labour market we remain in the southern hemisphere autumn.

Total employment rose 28.4k in April, stronger than the market median estimate of +15k and Westpac’s estimate of +10k. The three month average is now 22.4k from 24.9k in March and 22.0k in February indicative of sound employment growth so far in 2019.

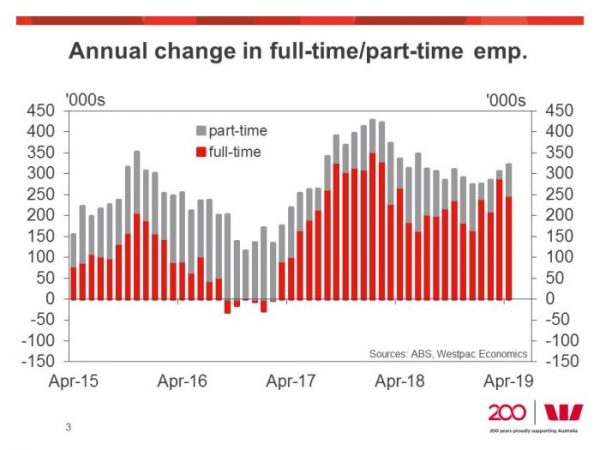

In the year to April employment has lifted 323k or 2.6%yr, an acceleration from the 305k/2.4%yr in March and 274k and 2.2%yr at the end on 2019. For now, the ABS is reporting a much stronger labour market than what is represented in the various business surveys. With the collapse of the employment indicators in the AI Group and NAB business surveys, Westpac’s Jobs Index is now pointing a pace of growth around 2.0%yr by Q4 which is consistent with what Job Ads is suggesting but we caution that ABS Job Vacancies are suggesting a more robust picture.

In the month, full-time employment fell 6.3k in April to be up 248.1k/2.9% in the year while part-time employment gained 34.7k to be up 74.8k or 1.9% in the year. Hours worked lifted 0.1% to be up 1.9%yr, a moderation from the 3.0%yr in March. But it is worth nothing that this year saw Easter and the ANZAC holidays fall very close to each other with many taking advantage of that to have an extended holiday.

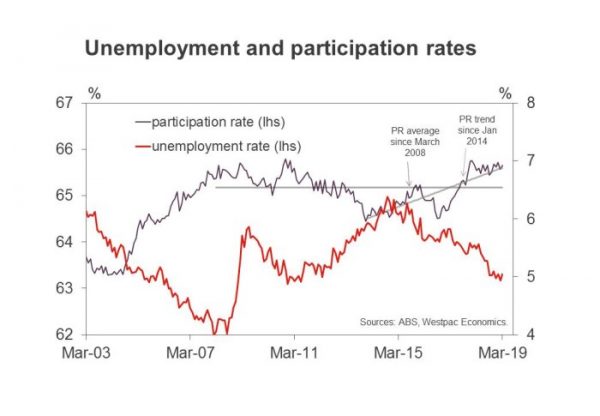

The big surprise in the April survey was the jump in the unemployment rate from 5.1% (was 5.05% revised to 5.07%) to 5.2% (5.20%). This was the result of a jump in the participation rate to a new record high of 65.85%. This jump in participation saw a 49.6k jump in the labour force even though growth in the working age population slowed to +25.9k in April from +39.0k in March.

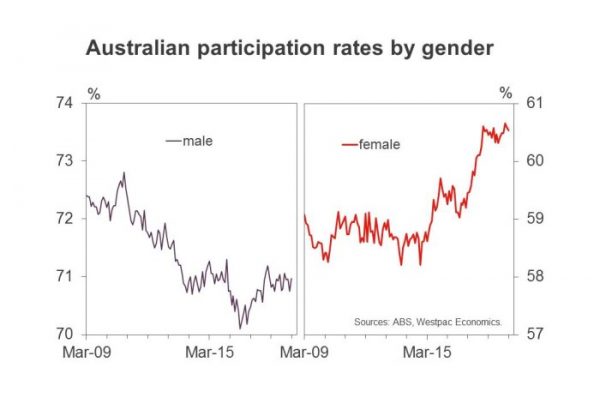

It is worth nothing that the rise in participation continues to be a female story. In the month male participation fell to 70.89% from 70.95% in March while female participation hit a new record high of 60.98% from 60.61% in March.

The impact of rising participation has been significant. If participation had held around the average it was for the last half of 2018 (65.58%) then the unemployment rate in April would have been 4.8%. But we caution that it is normal for strong employment growth to be associated with rising participation, just as it is normal for weak employment growth to be associated with falling participation.

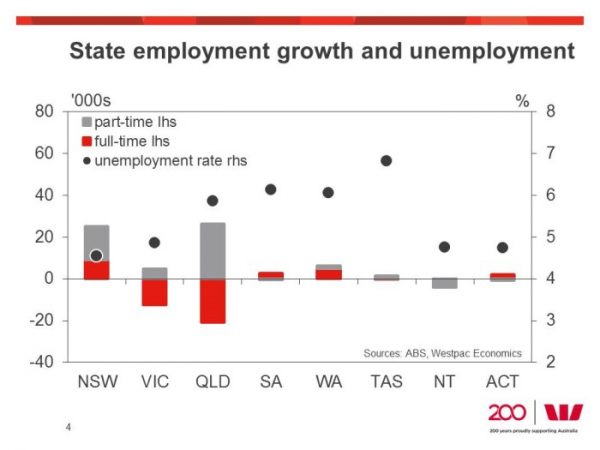

By state, unemployment rose in NSW (4.5% from 4.3%), Victoria (4.9% from 4.6%), South Australian (6.1% from 5.9%), WA (6.1% from 6.0%) and Tasmania (6.8% from 6.7%).

Employment gains in the month were concentrated in NSW (+25.1k), Qld (5.4k) and WA (6.4k). Employment fell in Victoria (–7.6k). In terms of participation NSW saw the largest jump (from 65.2% to 65.6%) while it fell in Victoria (65.9% from 66.0%)

But note, the state that is on the forefront of the downturn in dwelling investment, NSW, has seen the three month average gain in employment slow from 13.2k per month in January to 5.6k per month in April. We are expecting falling house prices in NSW will have a further negative impact on dwelling construction and consumption and thus cyclical employment in that state. But the dwelling construction correction is already more mature in NSW compared to Victoria and we are expecting to see Victorian employment soften as we move through the second half of 2019.