Markets sentiments generally stabilized today as it seems that US and China are still will to continue trade negotiations. Nevertheless, otherwise some pleasing words, there is nothing concrete, not even a scheduled meeting. Further decline in German 10-year yield, deeper into negative territory, is a sign of nervousness among investors. Gold is also holding firm around 1300 handle, as another sign of underlying risk aversion.

Some important economic data are released today but they’re largely ignored. UK unemployment dropped to fresh 44-year low of 3.8% in March. Eurozone industrial production contracted -0.3% in March. German ZEW economic sentiment deteriorated to -2.1 in May. But these data triggered little movements in the markets.

As for today, Sterling is so far the weakest one, followed by Yen and then Swiss Franc. New Zealand Dollar is the strongest, followed by Canadian and than Dollar. For the week, Swiss Franc and Yen remain overwhelmingly the strongest one. Dollar is catching up as third strongest for the moment. Aussie, Sterling and Canadian are the weakest.

Technically, recovery in Yen crosses are rather weak. Focus will be on temporary lows of 109.02, and 122.48 in USD/JPY and EUR/JPY respectively. We’d expect Yen crosses to resume decline, probably rather soon. AUD/USD continues to gyrate lower to 0.6913 fibonacci projection level. Firm break there could trigger downside acceleration. With today’s weakness, GBP/USD might be heading to 1.2865 key support. Firm break will confirm near term bearish reversal.

In Europe, currently, FTSE is up 0.87%. DAX is up 0.36%. CAC is up 1.00%. German 10-year yield is down -0.0079 at -0.075. Earlier in Asia,Nikkei dropped -0.59%. Hong Kong HSI dropped -1.50%. China Shanghai SSE dropped -0.69%. Singapore Strait Times dropped -0.33%. Japan 10-year JGB yield dropped -0.0061 to -0.052.

China agreed to continue trade negotiation with US, but warned of underestimating its determination

China indicated that it has agreed to continue negotiation with the US even though both sides have raised tariffs on either other imports. Chinese Foreign Ministry spokesman Geng Shuang said in a regular press briefing “my understanding is that China and the United States have agreed to continue pursuing relevant discussions.” But no detail was given on the way forward. Geng just said “as for how they are pursued, I think that hinges upon further consultations between the two sides.”

Additionally, Geng warned “we hope that the U.S. side does not misjudge the situation and not underestimate China’s determination and will to safeguard its interests.” China also typically denied any accusation of their wrong doings. Geng said “you absolutely can’t put the hat on China of reversing positions and going back on one’s promises.”

Trump: Have to make up the tremendous ground since ridiculous one sided formation of the WTO

Trump fired a series of tweets boasting his own tariff policies again. He noted there is now a “big a growing” steel industry after the 25% tariffs. He also blamed that there were “tremendous ground” lost to China since the “ridiculous one sided formation of the WTO”. He also claimed that it’s time for the farmers as “one of the biggest beneficiaries of what is happening now.” The country will make up for the differences if China doesn’t continue to buy from them.

Fed Williams: Decline decline in r* means limited policy space in future downturns

In prepared remarks, New York Fed President John Williams said the global shifts in demographics and productivity have two important implications for the economy and monetary policy. Firstly, “slower population and productivity growth translate directly into slower trend economic growth”. Secondly, “these trends have contributed to dramatic declines in the longer-term normal or ‘neutral’ real rate of interest, or r-star.”

And, the global decline in r-star will continue to pose “significant challenges” for monetary policy. There will be “limited policy space” for rate cuts in future downturns. Hence, “recoveries will be slow and inflation below target”. Also, the limitation in the ability of central banks to offset downturns results in an “adverse feedback loop”. That is “expectations of low future inflation drag down current inflation and further reduce available policy space”.

Separately, Williams told Bloomberg TV that “as tariffs get larger, assuming that happens, the effects will be bigger, boosting inflation in the next year and probably having negative effects on growth.” “We could probably get a couple tenths or two tenths on the inflation rate over the next year based on what has already been announced. If there (is) further escalation in terms of tariffs, those effects would get even larger”, he added.

UK unemployment rate dropped to 44-year low, but wage growth slowed

UK unemployment rate dropped to 3.8% in March, down from 3.9% and beat expectations. That’s a 44-year low since 1974. Overall employment rate was 76.1%, joint highest on record since 1971.

However, wage growth slowed with average weekly earnings including bonus rose 3.2% 3moy, down from 3.5% 3moy and missed expectation of 3.4% 3moy. Weekly earnings excluding bonus also slowed to 3.3% 3moy, down from 3.4% 3moy, matched expectations.

German ZEW dropped to -2.1, restrained economic growth for the next six months

German ZEW economic sentiment dropped to -2.1 in May, down from 3.1 and missed expectation of 5.0. It’s also well below long term average of 22.1. Current situation index, though, rose to 8.2, up from 5.5 and beat expectation of 6.0. Eurozone ZEW economic sentiment dropped to -1.6, down from 4.5 and missed expectation of 5.0. Current situation gauge rose 6.2 pts to 7.0.

ZEW noted that “The development of production and exports in Germany as well as Eurostat’s most recent flash estimate of GDP growth in the euro area in the first quarter of 2019 give rise to the hope that the German economy, too, has grown more strongly than expected in the first quarter. ”

ZEW President Achim Wambach said: “The decline in the ZEW Indicator of Economic Sentiment shows that the financial market experts continue to expect restrained economic growth in Germany for the next six months. The most recent escalation in the trade dispute between the USA and China again increases the uncertainty regarding German exports – a key factor for the growth of the gross domestic product”.

Eurozone industrial production dropped -03% mom, -0.6% yoy

Eurozone industrial production dropped -0.3% mom in March, matched expectations. Over the year, industrial production dropped -0.6% yoy, above expectation of -0.8% yoy. EU28 industrial production dropped -0.1% mom, rose 0.4% yoy.

Over the month, among Member States for which data are available, the largest decreases in industrial production were registered in Malta (-3.7%), Greece (-2.7%) and Sweden (-2.3%). The highest increases were observed in Lithuania (3.5%), Denmark (1.8%) and Slovakia (1.2%).

Also released in European session, German CPI was finalized at 1.0% mom, 2.0% yoy in April. Swiss PPI rose 0.0% mom, dropped -0.6% yoy in April.

Australia NAB business conditions unwound March rebound, employment dived

In April, Australia NAB Business Conditions deteriorated further to 3, down from 7 and missed expectation of 4. The surprised jumped in Conditions from 4 to 7 was more than unwound. Business Confidence, though, improved slightly to 0, up from -1, but still missed expectation of 1.

Looking at the details, business conditions, confidence and forwards orders are all below average. More worryingly, there was sharp decline in employment index from 6 to -1, first below average reading since late 2016. By industry, largest fall in employment occurred in retail, manufacturing an wholesale. But overall deterioration was rather broad-based.

Alan Oster, NAB Group Chief Economist noted: “We will continue to watch the employment index as well as the other forward looking variables over coming months for further slowing. In particular, the readings of labour market related variables will remain important as, for now, the interest rate outlook appears to hinge on continuing strength in the labour market”.

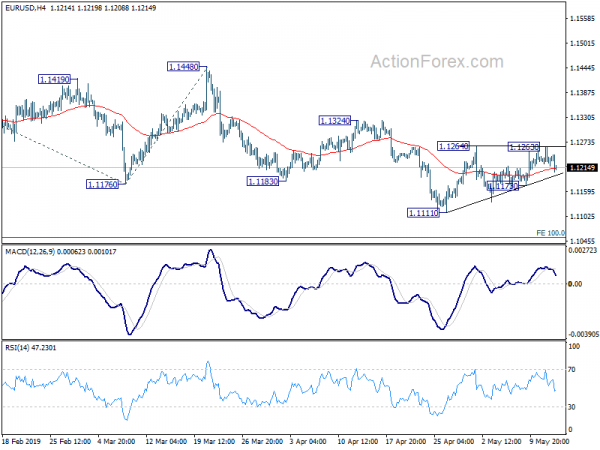

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1211; (P) 1.1237; (R1) 1.1251; More…..

EUR/USD weakens notably after rejection by 1.1264 resistance, but stays in consolidation from 1.1111. Intraday bias remains neutral and outlook is unchanged. In case of another rise, upside should be limited well below 1.1324 resistance to bring fall resumption. On the downside, below 1.1173 minor support will turn bias to the downside for 1.1111 low. Break will extend down trend to 100% projection of 1.1448 to 1.1183 from 1.1324 at 1.1059. Break will target 161.8% projection at 1.0895.

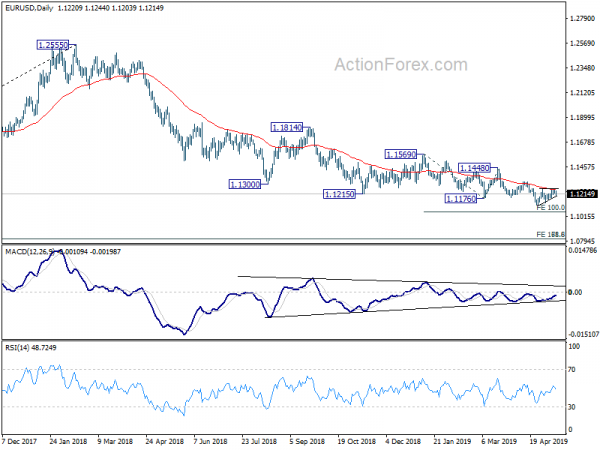

In the bigger picture, down trend from 1.2555 (2018 high) has just resumed. 61.8% retracement of 1.0339 (2016 low) to 1.2555 (2018 high) at 1.1186 was also taken out. Current fall should now target 78.6% retracement at 1.0813. Sustained break there will pave the way to retest 1.0339. On the downside, break of 1.1448 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Current Account (JPY) Mar P | 1.27T | 1.71T | 1.96T | 1.90T |

| 01:30 | AUD | NAB Business Conditions Apr | 3 | 4 | 7 | |

| 01:30 | AUD | NAB Business Confidence Apr | 0 | 1 | 0 | -1 |

| 05:00 | JPY | Eco Watchers Survey Current Apr | 45.3 | 45.8 | 44.8 | |

| 06:00 | EUR | German CPI M/M Apr F | 1.00% | 1.00% | 1.00% | |

| 06:00 | EUR | German CPI Y/Y Apr F | 2.00% | 2.00% | 2.00% | |

| 06:30 | CHF | Producer & Import Prices M/M Apr | 0.00% | 0.20% | 0.30% | |

| 06:30 | CHF | Producer & Import Prices Y/Y Apr | -0.60% | -0.40% | -0.20% | |

| 08:30 | GBP | Jobless Claims Change Apr | 24.7K | 24.2K | 28.3K | |

| 08:30 | GBP | Average Weekly Earnings 3M/Y Mar | 3.20% | 3.40% | 3.50% | |

| 08:30 | GBP | Weekly Earnings ex Bonus 3M/Y Mar | 3.30% | 3.30% | 3.40% | |

| 08:30 | GBP | ILO Unemployment Rate 3Mths Mar | 3.80% | 3.90% | 3.90% | |

| 09:00 | EUR | Eurozone Industrial Production M/M Mar | -0.30% | -0.30% | -0.20% | |

| 09:00 | EUR | Eurozone Industrial Production w.d.a. Y/Y Mar | -0.60% | -0.80% | -0.30% | |

| 09:00 | EUR | German ZEW Economic Sentiment May | -2.1 | 5 | 3.1 | |

| 09:00 | EUR | German ZEW Current Situation May | 8.2 | 6 | 5.5 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment May | -1.6 | 5 | 4.5 | |

| 12:30 | USD | Import Price Index M/M Apr | 0.20% | 0.70% | 0.60% |